Bitcoin Buyers Continue To Book Profits Near $39,000! Is BTC Price In Good Health?

The market is experiencing a significant Santa Claus rally, with Bitcoin maintaining a robust position above the $38,000 level. Yet, it’s anticipated that investors might begin selling off their Bitcoin holdings as the price reaches a 19-month peak. Following this, Bitcoin has seen a notable selloff from its recent high of $39K, leading to questions about its present health.

Short-Term Traders Turn Bearish

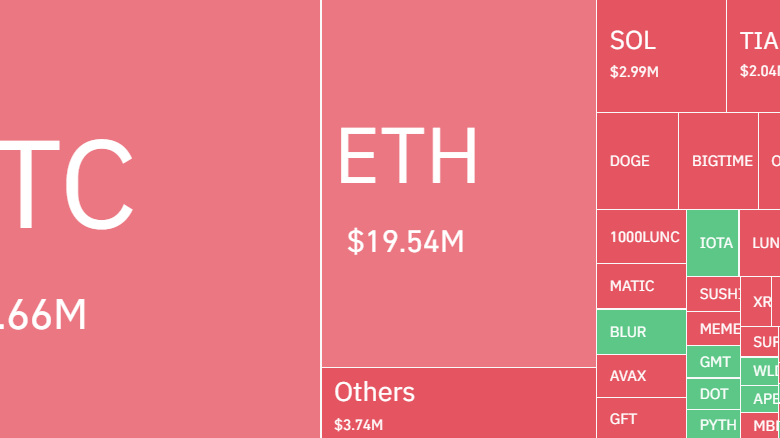

Bitcoin price has touched a record high after 1.7 years, with the price touching $39,000 today. Additionally, the Open Interest has also reached a 19-month high of $17.5 billion. As BTC price rose from $37.5K low, over $35 million worth of positions were liquidated, with short-positions getting liquidated nearly $31 million.

Nevertheless, with the price facing rejection above $39,000, traders rushed quickly to lock their profits, resulting in Bitcoin experiencing a liquidation of around $2.8 million. This decline appears to be a temporary volatility, as the outlook from options data remains bullish and the potential approval of a spot ETF is on the edge.

Data from Deribit derivatives exchange shows a rise in call options over puts for Bitcoin, suggesting investors’ hopes for its price increase in early 2024. Deribit shows a declining put-call ratio, especially for March and June 2024 expiries, indicating a bullish market trend.

Additionally, the Netflow for Bitcoin continues to hover around a negative region, currently at -670 Bitcoin. This suggests investors are now increasingly withdrawing BTC from exchanges, signaling a ‘hodling’ sentiment.

However, the current sentiment among short traders is turning bearish. Coinglass data indicates that the long/short ratio is falling below 1 to 0.7934. This suggests that approximately 56% of positions are now expecting a price drop. Despite this, bulls remain hopeful, maintaining 44% of positions as long, countering the rising selling demand.

What’s Next For BTC Price?

Bitcoin managed to surpass the $38,000 resistance and successfully met the $39K level. However, sellers were quick to open short positions near this level, resulting in minor pullbacks. As of writing, BTC price trades at $38,777, surging over 2.7% from yesterday’s rate.

Repeatedly testing a resistance level often leads to its weakening. If buyers can maintain Bitcoin’s value above the recent breakout level, the chances of a surge towards $40,000 increase. However, this price could face a notable challenge as sellers are waiting for their final move.

If sellers aim to stop this upward trend, they need to rapidly lower Bitcoin’s price below the 20-day EMA and the current uptrend line. This action could trigger a drop to the firm support level of $34,900. A robust recovery from this point might result in the Bitcoin price remaining within the $34,800 to $38,000 range for some additional time.

With rising moving averages and RSI trading just below the overbought region, Bitcoin now gives an advantage to spot buyers.