Solana Poised For A Big Surge If It Surpasses $80! Can Bulls Hold The SOL Price Amid Rising Adoption?

Although this week began with a downturn in the market, there’s been a notable recovery from recent lows, signaled by Bitcoin’s effort to climb over the $43K mark. Solana is taking this opportunity as it made impressive gains in the past few hours. Now, as it approaches the critical $80 level, Solana is preparing for a major move, according to on-chain details.

Solana Network Sees Increased Adoption

The price of SOL experienced a significant increase, rising from $68 to $76. This rise led to a massive short-liquidation among investors, as reported by Coinglass, with over $4.5 million in short positions being liquidated. This indicates that many traders who had bet against SOL were caught off guard by the price surge.

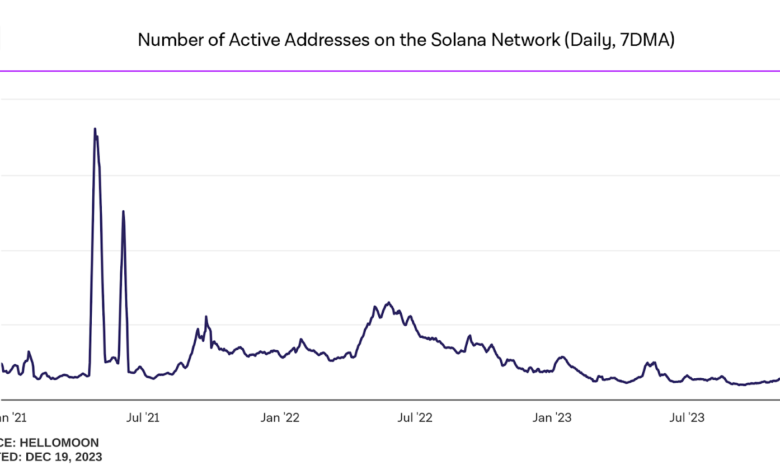

Furthermore, on-chain data suggests that Solana is experiencing increased adoption, contributing to a positive influence in its price. The rising popularity of meme coins, such as Bonk, has attracted more users to the SOL network. This influx of new users is positively impacting the value of SOL.

The SOL network has witnessed a significant increase in activity, reaching a 1.5-year peak in terms of active and new addresses. Specifically, the number of active addresses hit 861,000, while new addresses reached 335,000. Additionally, there has been a notable rise in the value of transactions conducted on-chain.

Since December 3, this metric has been steadily increasing, recently reaching around $20.4 billion. However, this figure is still nothing compared to the peak in 2022, when the transaction value soared to $3 trillion.

At present, there’s a battle between bulls and bears as SOL faces resistance near its peak values. The long/short ratio is currently at 1.0251, indicating a nearly balanced market sentiment: 51% of positions are anticipating an increase in price, while 49% are inclined towards short positions.

What’s Next For SOL Price?

Solana’s SOL experienced a decline as sellers resisted a surge above $76. However, bulls have been holding the price in a bullish region, preparing for another attempt to break the trend line. As of writing, SOL price trades at $73.4, surging over 3.1% from yesterday’s rate.

Since the rally’s inception, the bulls have consistently prevented the SOL price from closing below the 20-day EMA. Therefore, a breach below this level could activate the stop-loss orders of numerous traders, potentially leading to a downturn towards the ascending channel’s support line, followed by a possible drop to the key psychological level of $50.

To avert a more significant pullback, bulls need to robustly defend the 20-day EMA and push the price above the channel’s resistance at $80. Successfully doing so could pave the way for a potential surge towards $100.