Cardano Price Stagnant at $0.48, But Charts Point to Potential Upswing

Cardano (ADA), the eighth-largest cryptocurrency, finds itself in a perplexing situation as it grapples with a battle between bullish and bearish forces, leaving investors deciphering mixed signals in a turbulent market.

The optimism that briefly emerged on January 29th, as ADA’s market structure turned bullish, proved short-lived, unable to overcome the critical $0.50 support level, and remaining stuck in the $0.48 territory.

Social media sentiment, often a precursor to price movements, has not provided solace either. Santiment’s “weighted social sentiment” metric has steadily declined over the past ten days, reflecting tepid investor confidence.

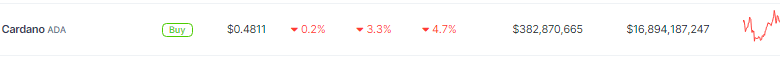

Source: Coingecko

ADA’s Metrics: Confusion Amidst Bullish Signals

The confusion deepens when examining on-chain metrics. While the negative MVRV ratio suggests ADA might be undervalued, the sustained presence in negative territory raises concerns. Conversely, the increasing number of active addresses, signaling heightened network activity, offers a glimmer of hope for bullish investors.

Complicating the outlook is the liquidation heatmap from Hyblock. Two prominent zones add complexity: the $0.45-$0.48 region, hosting an estimated $300 million in liquidation levels, and the $0.52-$0.54 zone, carrying similar selling pressure. A drop to the former could trigger buying activity as long positions close, while the latter’s fate hinges on Bitcoin’s (BTC) movement, given ADA’s tendency to follow its lead.

ADA currently trading at $0.4809 on the daily chart: TradingView.com

Industry experts remain divided on Cardano’s future. Santiment suggests that the increased bearish sentiment might hint at an impending price bounce, while others exercise caution, citing the lack of definitive follow-through after the initial bullish market structure shift.

🐻 With #crypto market caps ranging and lacking the usual growth traders have been accustomed to since the #bullcycle began in October, there is a notable #bearish sentiment that has taken hold of #crypto discourse this week. #Bitcoin, #Ethereum, #BinanceCoin,

(Cont) 👇 pic.twitter.com/c3M4bPxlhi

— Santiment (@santimentfeed) February 5, 2024

Source: Santiment

Cardano Dips Amidst Stability: Mixed Signals

Cardano (ADA) is currently navigating a bearish trend, experiencing a 2.93% decrease in the past 24 hours and declines of 1.13% and 10.33% over the past week and month respectively. Despite this dip, it maintains its position as the 8th largest cryptocurrency by market cap, suggesting some underlying stability.

While the short-term technical picture appears bleak, longer-term indicators offer potential for cautious optimism. The increasing number of active addresses hints at growing network activity, a potential bullish sign.

Additionally, the negative MVRV ratio, although concerning in its extended presence, could indicate undervaluation. However, this needs to be balanced against the crucial resistance zones identified around $0.54-$0.56, which could hinder upward momentum.

Overall, ADA’s future trajectory remains uncertain. Further analysis would benefit from exploring the reasons behind the recent price decline, potential catalysts for recovery, and a deeper dive into long-term fundamentals like development progress and adoption rate.

Featured image from Freepik, chart from TradingView

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.