Shiba Inu (SHIB) Price Prediction: What’s Next for SHIB?

Shiba Inu (SHIB) has enjoyed recent price gains, but its burn rate seems to be lagging behind.

You might like: Shiba Inu Whales Are Stockpiling Trillions

Burn Rate Takes a Tumble

Shiba Inu (SHIB)’s burn rate, often touted as a deflationary mechanism, has exhibited erratic behavior lately. On February 13th, it soared over 1,800% but then plunged into negative territory, reaching -74.38%. Currently, it sits at -71.33% for the last 24 hours and -39.5% for the past week.

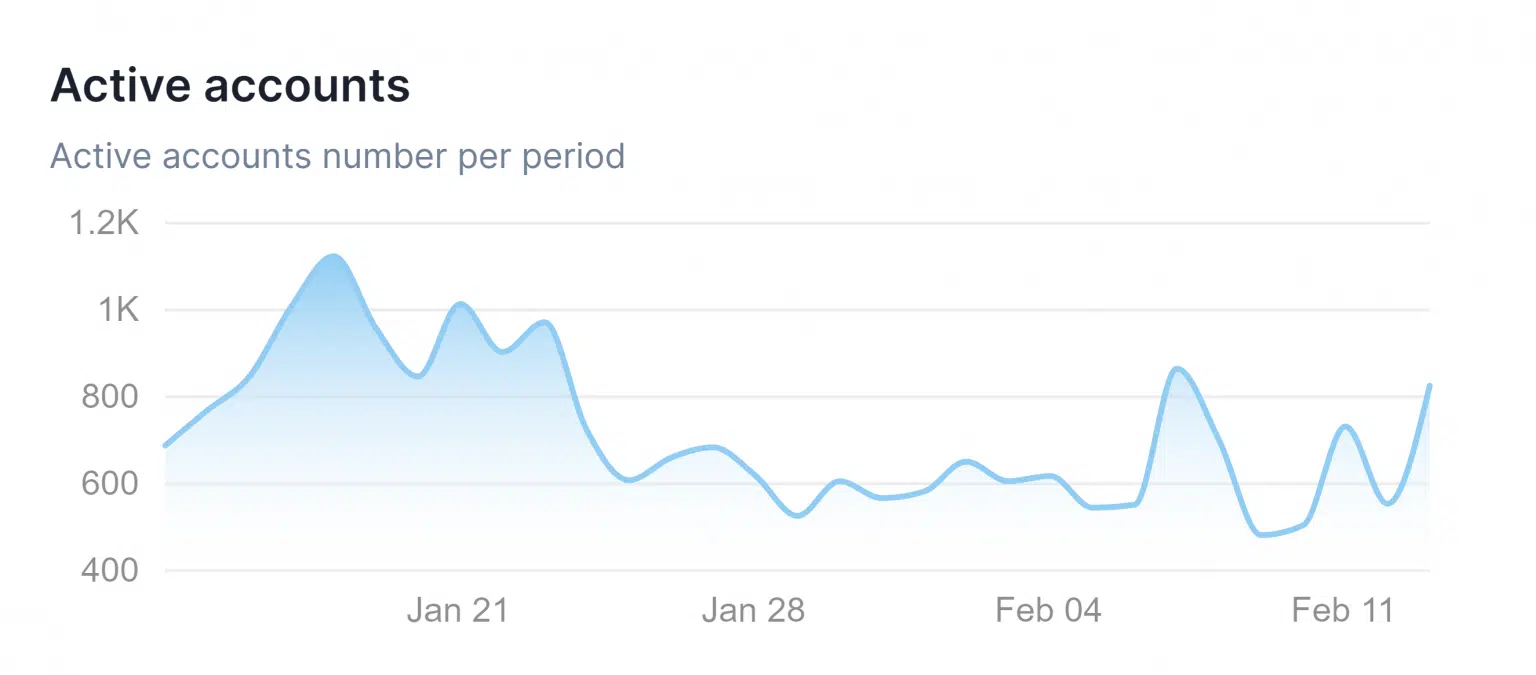

Shibarium Activity Fluctuates

This volatility coincides with changes in key metrics on Shibarium, SHIB’s Layer 2 (L2) platform. While new and active addresses on the network initially boosted the burn rate, they followed similar trend patterns, experiencing both significant drops and subsequent surges.

Positive Price Performance, Despite the Dip

Despite the burn rate’s dip, SHIB’s price has maintained an upward trajectory, showcasing an over 1% gain at the time of writing. Interestingly, it hasn’t breached its short-term Moving Average resistance yet, but it managed to surpass the neutral line on its Relative Strength Index (RSI), indicating a positive sentiment.

What’s Next for Shiba Inu?

The contrasting trends between price and burn rate raise questions about SHIB’s long-term outlook. Here are some key points to consider:

- Impact of Negative Burn Rate: While a negative burn rate doesn’t directly affect circulating supply, it contradicts the deflationary narrative surrounding SHIB. This could affect investor confidence.

- Shibarium’s Potential: Increased activity on Shibarium is a positive sign for network adoption and future burn rate increases.

- Price Performance: Despite the burn rate dip, SHIB’s price growth suggests continued investor interest.

In the comment section, you can freely share your comments and opinions about the topic. Additionally, don’t forget to follow us on Telegram, YouTube, and Twitter for the latest news and updates.