US Senators Want SEC to Pump the Brakes on Crypto ETFs

Senators Jack Reed and Laphonza Butler have urged the Securities and Exchange Commission (SEC) to refrain from approving additional crypto exchange-traded products (ETPs), especially those tied to cryptocurrencies other than Bitcoin.

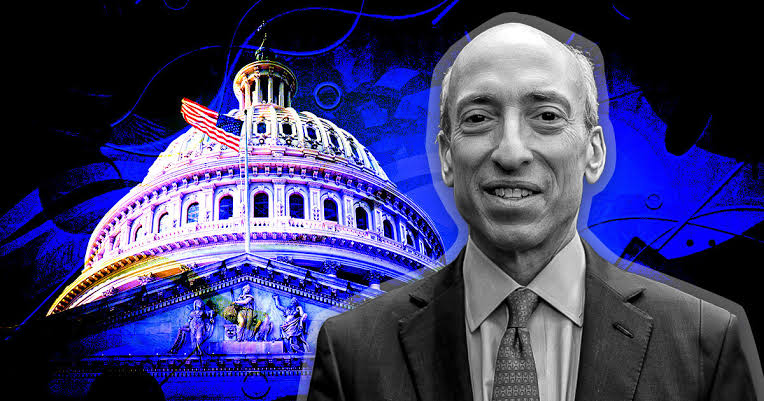

In a letter to SEC Chair Gary Gensler dated March 11, the senators expressed concerns about the insufficient trading volumes and market integrity in cryptocurrencies like Ethereum, which they fear could expose retail investors to fraud and manipulation risks.

Their letter follows the recent launch of ten spot Bitcoin ETFs in the U.S. in January, which led to a resurgence in the cryptocurrency market, with Bitcoin reaching highs of US$73,737.

This move comes as the SEC continues to deliberate on spot Ethereum ETFs. Bloomberg analysts have lowered the likelihood of a spot Ethereum ETF approval to 35%, and the SEC has postponed its decision on several proposed Ethereum ETFs. An announcement is expected in May.

While institutional interest in Bitcoin is increasing, challenges within the crypto industry, such as security and compliance issues, could potentially hinder institutional adoption.