Access to Pharmaceuticals like Ozempic Are Too Often Behind Iniquitous Paywalls

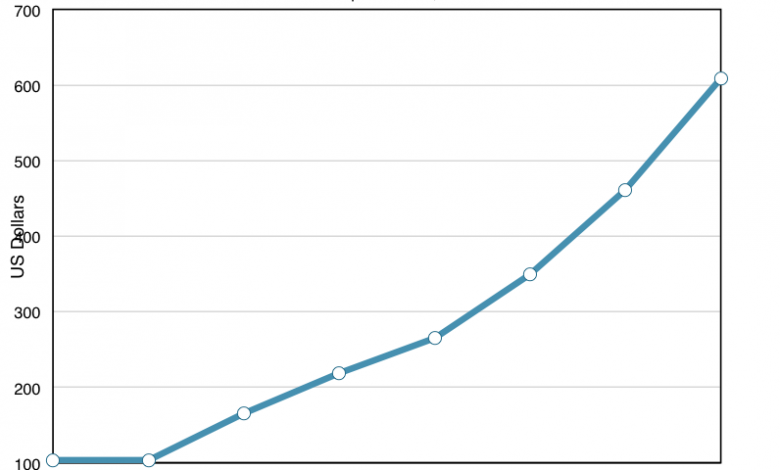

The Journal of the American Medical Association (JAMA) Network Open recently published a study on diabetis medicines, which led to an uncomfortable finding: Novo Nordisk’s famous diabetes drug Ozempic costs around a thousand dollars per month to US patients could be made, and sold profitably for as little as $5. The JAMA study comes as a critical third-party investigation into how easy it is to get drugs that can save lives and how the drug business sets prices.

İçindekiler

The study was conducted by researchers from Yale University, King’s College Hospital in London, and the charity Doctors Without Borders. The team consists of Melissa J. Barber, Dzintars Gotham, and Helen Bygrave, who found that it costs anywhere between 89 cents to $4.73 to manufacture one month’s worth of Ozempic. This included the profit margin.

Upon noticing the 200x markup, the company faced flak from patients struggling to afford healthcare, lawmakers, and people who support accessible healthcare.

Ozempic is an injectable medicine used to treat type 2 diabetes. It has also gained popularity over the past year as people find it helpful in weight loss. However, the high costs have prompted many insurance companies to strike this drug off their plans, ultimately lowering its accessibility to the patients that might need it the most.

Novo Nordisk, the Danish pharmaceutical behemoth behind Ozempic, has refused to make any comments on the manufacturing cost of the drug. Instead, it took a defensive stance and stated that it spent a lot of money on research and development last year—nearly $5 billion. They further stated that the company is committed to customer access, reflected by the fact that 75% of its gross sales go to rebates and discounts.

Despite the justifications, a majority of people didn’t find the markup justifiable and the study’s results rekindled the long standing debate about drug prices in the US. The drug companies in the US have been accused of setting “ridiculously high prices” that often do not have anything to do with how much it really costs to make the drug. The analysts who worked on the study also reiterate that the big difference in price between Ozempic’s production cost and its market price is the reflection of a larger problem spanning the entire pharmaceutical industry.

As the study’s corresponding author, Yale public health economist Melissa Barber said:

“The profit margin is enormous. There should be a conversation in policy about what is a fair price.”

The study’s results arrive at a time when politicians are increasingly pressuring drug companies to reduce the rising costs of insulin and other diabetes treatments. For a few years now, people and lawmakers have closely monitored Novo Nordisk and its competitors due to the high costs of these life-saving drugs.

Not only might the study impact the diabetic market but also the market for weight loss, as Novo Nordisk’s Wegovy, a drug that shares an active ingredient with Ozempic, has encountered pricing issues as well. Further research by academics from the University of Liverpool has found that Wegovy can be produced for as little as $40 a month.

Such massive price differences have led to more and more people calling for greater awareness and regulatory oversight in the pharmacy industry. Critics contend that the current system, which permits steep prices and stifles competition, is both unsustainable and detrimental to public health.

According to Dr. Mark Thompson, a healthcare policy expert at the Brookings Institution:

“This research shows how important it is to do a full analysis of the cost and importance of life-saving drugs. We must find a balance between incentivizing innovation and ensuring that patients can access the treatments they need.”

In response, Novo Nordisk has defended its pricing strategy, asserting that the majority of patients can obtain Ozempic through insurance or savings programs, so the list price doesn’t really show how much it costs patients. Furthermore, the company reaffirmed that it was committed to funding research and development (R&D) so that new, cutting-edge medicines could be brought to market.

Critics, however, argue that the high cost of medications puts a lot of stress on the healthcare system as a whole and that refunds and discounts alone don’t get to the root of the problem. They maintain that the pharmaceutical industry must undergo fundamental changes that will make it transparent, accountable, and competitive.

The study’s results have evidently struck a chord, showing how complicated and tense the relationship is between drug companies, insurance companies, and patients while the discussion around the price of Ozempic continues. Although the future is uncertain, the fact that diabetes drugs are getting more attention may lead to changes in business practices and government policies.

This, however, isn’t a standalone case, as we will see below:

Martin Shkreli and Turing Pharmaceuticals (2015)

Turing Pharmaceuticals, run by former hedge fund manager Martin Shkreli, bought the rights to Daraprim in 2015. Daraprim is a drug that has been around for decades and is used to treat a parasite illness that can be fatal.

The price of this drug went from $13.50 per pill to a staggering $750 per pill, an overnight rise of more than 5,000%. It created a negative sentiment among the people, bringing the issue of drug prices into public discourse. Shkreli, who went on to be known by the moniker “Pharma Bro,” blatantly defended the price hike, claiming it was necessary to “fund research and development.”

Many people were of the opinion that the rise wasn’t warranted and put the lives of people who weren’t well at risk. The controversy led to congressional hearings and increased scrutiny of the pharmaceutical industry’s pricing practices. Shkreli was later convicted of securities fraud in an unrelated case and sentenced to seven years in prison.

Mylan and the EpiPen (2016)

Mylan was put in an unfavorable position in 2016 when it became known to the general public that the cost of its life-saving auto-injector for severe allergic reactions, EpiPen, had jumped by about 400% since 2007. The EpiPen, which many patients with severe allergies rely on in emergencies, has become increasingly unaffordable for patients and families. Consequently, Mylan faced scrutiny from lawmakers, healthcare providers, and the public owing to its pricing policy, which ultimately led to congressional hearings and investigations.

Mylan’s launch of a generic EpiPen and expanded patient assistance followed criticism of its pricing. It further ignited discussions around access to essential drugs in the US, underscoring the need for transparency and regulations in the pharma sector.

Valeant Pharmaceuticals (2015-2016)

In 2015-2016, Valeant Pharmaceuticals faced backlash for its infamous strategy of acquiring established drugs and increasing their prices by several times. Such unethical practices drew sharp criticism from lawmakers, healthcare providers, and the public, placing it at the center of a heated debate over pharmaceutical pricing.

One such well-known instance was when Valeant hiked the prices of Syprine and Cupriminel, two leading drugs to treat Wilson’s disease, by almost 3,000% and 6,000% after acquiring their rights. Valeant also faced scrutiny over its ties to Philidor, a specialty pharmacy accused of boosting sales and circumventing insurance limits. These scandals tanked Valeant’s stock, ousted its CEO, and prompted a name change to Bausch Health in 2018 to mitigate the fallout.

Gilead Sciences and Sovaldi (2013)

Gilead Sciences faced intense criticism for setting a price tag of $84,000 for a 12-week course of Sovaldi, a revolutionary treatment for hepatitis C, a chronic viral infection that can lead to life-threatening liver damage. It led to an intense debate about unrealistic and predatory pricing mechanisms of life-saving drugs, such as Sovaldi.

Despite a barrage of criticism, Gilead did not budge as it cited the drug’s potential to improve the patient’s health and quality of life. The controversy again laid bare the pharmaceutical industry’s perpetual struggle to balance innovation, profitability, and patient access.

Insulin Price Increases (2010s)

In the 2010s, the rising cost of insulin in the US became a major point of contention, with many patients struggling to afford the life-sustaining drug. Eli Lilly, Sanofi, and Novo Nordisk, which control 90% of the global insulin market, faced intense criticism from patients, advocates, and policymakers for their pricing practices. The controversy highlighted the pressing need for more accessible and affordable insulin options.

Patients, organizations, and politicians urged for greater transparency, competition, and regulatory intervention to resolve the insulin affordability crisis. Under public pressure, the companies announced initiatives to reduce out-of-pocket costs for patients, including discounts and launching generic versions of their products. However, critics argued that these measures were insufficient and called for more comprehensive reforms to address the root causes of high insulin prices.

Mallinckrodt Pharmaceuticals and Acthar Gel (2001-2017)

In 2001, Mallinckrodt Pharmaceuticals purchased the rights to Acthar Gel, a medication used to treat multiple sclerosis and infantile spasms. Post-acquisition, the drug’s price skyrocketed by 85,000% during the course of the following 16 years, from $40 a vial to over $34,000. Legislators, along with medical professionals and the general public, expressed concern about the sudden surge in costs and questioned its rationale.

Mallinckrodt justified the price by citing the drug’s R&D expenses and effectiveness. Nonetheless, lawmakers didn’t yield to these explanations, especially due to the fact that Acthar Gel had been on the market for decades without any tangible changes.

The controversy led to investigations by the Federal Trade Commission and the US Department of Justice, and the company eventually consented to pay $100 million to settle allegations of anti-competitive behavior.

Rodelis Therapeutics and Cycloserine (2015)

2015 saw Rodelis Therapeutics acquire the rights to cycloserine, an antibiotic used to treat drug-resistant tuberculosis. The deal was signed with a non-profit organization affiliated with Purdue University. The drug’s price was immediately hiked by the firm from $500 for thirty pills to $10,800, a 20-fold increase. Patients, activists, and medical professionals fumed over the decision, claiming that the medicine would become unaffordable for those who needed it the most.

Following the public backlash, Rodelis Therapeutics returned the rights to cycloserine to the Purdue Research Foundation, which then reinstated the original price. The case brought to light the plausible ill effects of drug acquisitions on accessibility and cost, especially when it comes to drugs used to treat rather uncommon and serious conditions.

Valeant Pharmaceuticals and Heart Medications (2015)

On top of the aforementioned disputes, Valeant Pharmaceuticals faced criticism in 2015 for significantly raising the prices of two heart medications, Nitroprusside and Isoproterenol, which it had acquired from Marathon Pharmaceuticals. The company hiked the price of a vial of Nitroprusside, used to treat high blood pressure and heart failure, by 212%, while Isoproterenol, used to treat low blood pressure and slow heart rate, got costlier by over 500%.

These price hikes led to a Senate investigation and further fueled the ongoing debate over pharmaceutical pricing practices. Many hospitals reported that the higher prices forced them to use alternative treatments or absorb the increased costs.

Hospitals stated that they were compelled to either absorb the additional expenses or employ other therapies as a result of the price increases. The Nitroprusside and Isoproterenol instance highlighted more general worries about how acquisitions and price rises may affect patients’ access to necessary drugs.

The Bright Side: A Few Businesses Are Attempting to Provide Fair and Affordable Access To Substances

#1. Mark Cuban’s CostPlusDrugs

Mark Cuban’s online pharmacy, Cost Plus Drugs, has been making significant strides in providing affordable access to prescription medications. Cost Plus Drugs provides generic medications at far cheaper costs than typical pharmacies since it negotiates directly with manufacturers rather than routing the purchase via intermediaries.

Customers struggling with high drug costs have responded well to the company’s clear pricing approach, which includes a flat 15% markup, a $3 pharmacy labor fee, and a $5 delivery charge. Although the private company’s precise financial information is not available to the public, Cuban has said that Cost Plus Drugs is not profitable at the moment, but instead, it is focused on growing its influence and disrupting the pharmaceutical sector.

#2. Teva Pharmaceutical Industries

One of the biggest producers of generic medications globally is Teva Pharmaceutical, a multinational corporation based in Israel. With more than 3,500 items in its portfolio, the firm provides everyday care to almost 200 million patients across 60 countries. Teva continues to be a prominent player in the generic medication industry despite difficulties stemming from legal troubles and generic competition.

Financially speaking, the company’s revenue is $16.7 billion, with a $8.0 billion gross profit, $2.5 billion operating income, and $3.5 billion net income.

#3. Sandoz, a Novartis Subsidiary

Global leaders in biosimilars and generic drugs include Sandoz and Novartis, two divisions of the multinational pharmaceutical conglomerate Novartis. The company’s goal is to create and distribute high-quality, reasonably priced medications in order to lead the way in healthcare access. With operations in more than 100 nations, Sandoz provides a portfolio of almost 1,000 compounds.

In 2020, the firm posted $9.6 billion in net sales and $1.0 billion in operating income and generated $2.3 billion from its core operations.

In order to establish itself as the top European generics firm and a world leader in biosimilars, Novartis declared in 2023 that it intended to split off Sandoz as a separate business. It is anticipated that the spin-off will be finalized in the latter part of 2023, subject to market circumstances, tax decisions, and shareholder consent. After becoming independent from its parent company, Sandoz aims to concentrate on fulfilling its mission of providing patients with access while leveraging its strong brand and leading position in the global generics and biosimilars market.

These businesses, along with others in the generic medicine industry, are essential to expanding patient access to reasonably priced drugs and bringing down the cost of healthcare for individuals and global healthcare systems. However, the complicated regulatory environment, patent rules, and pharmaceutical business nonetheless hamper widespread access to affordable medications.

The high expense of medications like Ozempic continues to be a daily challenge for the millions of Americans who have diabetes, forcing many to choose between taking care of their health and paying for other necessities. Thus, we hope that when decision-makers in the governmental, business, and patient advocacy sectors consider the study’s implications, it will act as a spark for significant change, guaranteeing that life-saving drugs are available and reasonably priced for everyone who needs them.

Click here to learn how insulin-dependent diabetics may soon benefit from oral delivery of medication.