ETF Update: More Approvals Incoming, Litecoin Gaining Spotlight, Ethereum in Focus Again

While the Bitcoin halving clock ticks closer, with block reward reduction estimated to occur on April 21st, the crypto market is experiencing a lull.

İçindekiler

Price-wise, BTC still holds a position of nearly $70,000, with a market capitalization of $1.39 trillion. Meanwhile, the total crypto market cap is at $2.7 trillion, with a total trading volume of $90 bln, according to CoinGecko.

Currently trading above $70K, Bitcoin’s price is right under its all-time high (ATH) of $73,808, which hit March 14th. So, a continuation of bullish momentum can push the price toward this ATH, while a drop below the $69K support level might lead to a decline toward the next support at $64K.

Since last month, the BTC price has been taking a breather after rallying as much as 67.3% in 2024 and 163% since mid-October. 2023, when the spot Bitcoin exchange-traded fund (ETF) narrative kicked off this bull run.

Click here to learn all about investing in Bitcoin (BTC).

What’s Up With Bitcoin Spot ETFs? Performance Update

The Securities and Exchange Commission (SEC) approved the first Bitcoin Spot ETF in the US in early January. With that, nearly a dozen Bitcoin ETFs made their debut, fast becoming a historical launch. These products recorded billions of dollars in inflows, with asset management giants BlackRock and Fidelity leading this race.

April, however, is turning out to be not so good for Bitcoin Spot ETFs. A notable slowdown has been noted in the flow of capital with many of these funds, such as ARK 21Shares Bitcoin ETF (ARKB), Franklin Bitcoin ETF (EZBC), Invesco Galaxy Bitcoin ETF (BTCO), Valkyrie Bitcoin Fund (BRRR), VanEck Bitcoin Trust (HODL), and WisdomTree Bitcoin Fund (BTCW) recording zero flows most of this month, as per the data provided by Farside.

However, this is not the complete picture, as these products were never the most active or popular. The leader, BlackRock’s IShares Bitcoin Trust Registered (IBIT), continues to attract capital, although the inflows have reduced significantly. This week, IBIT recorded $21.2 mln, $128.7 mln, $33.3 mln, and $192.1 mln in net inflows.

As of April 11th, BlackRock’s Bitcoin Spot ETF had $18.73 billion in total assets under management (AUM). Talking about IBIT’s success, Eric Balchunas, Bloomberg Intelligence Senior ETF Analyst, noted that in a matter of three months, the fund has been up more than fifty percent and raked in multi-billion dollars, which is “double any other BlackRock ETF, and they have 421 of them.”

No one comes close to BlackRock. However, Fidelity’s Fidelity Wise Origin Bitcoin Fund (FBTC) comes in second, recording inflows throughout this month, with its AUM at $10.38 bln. Bitwise Bitcoin ETF Trust (BITB), too, has been seeing a constant flow of funds, though its AUM is only $2.27 bln.

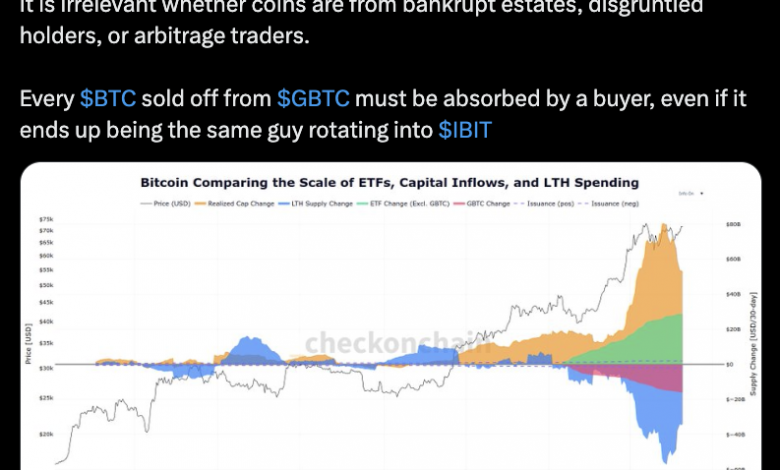

Amidst all this, Grayscale continues to record outflows from its Bitcoin ETF (GBTC). This week, on Wednesday, the fund saw its lowest outflow at $17.5 mln since converting its trust into an ETF. However, on Thursday, the net outflow once again increased to nearly $125 mln.

Just earlier this week, Grayscale CEO Michael Sonnenshein said that outflows from GBTC are reaching an “equilibrium.” This was attributed to selling activity related to settlements of bankrupt crypto companies like FTX being “largely behind us.” Meanwhile, analysts at Coinbase Institutional have noted that increased GBTC selling has potentially been due to Genesis selling shares as part of its bankruptcy process.

Additionally, this ETF charges the highest annual fees at 1.5%, which Sonnenshein anticipates will come down over time “as markets mature.”

As per Grayscale’s official website, GBTC now has $22.26 bln in AUM after losing more than 300,000 BTC, which accounts for nearly half of its holdings this year. This shows that BlackRock is fast catching up to the crypto-native fund that was launched over a decade ago in 2013.

With that, BlackRock is all set to take over the crown from Grayscale, and the gap between the two is closing fast to become the biggest Bitcoin Spot ETF in the market.

As for BTC, with inflows in other ETFs slowing down while GBTC continues to bleed, the price is feeling the heat, with little action over the past few weeks.

China Getting in on ETF Action? Approvals Coming Monday

While activity surrounding Bitcoin ETFs is going down in the US, Asia is gearing up to get involved. With Hong Kong aiming to become a digital asset hub, the authorities are said to be ready to approve exchange-traded funds. On Friday, Bloomberg reported that the city could approve spot BTC and Ether ETFs as early as Monday.

Ever since Bitcoin ETFs were approved in the US, Hong Kong-based firms have been seeing growing traction. HashKey Exchange has gained over 170,000 customers since its launch last August, while Bitcoin futures ETF manager CSOP Asset Management reported an increase of $120.7 million in its assets, with local securities brokerages and high-net-worth individuals (HNIWs) dominating this inflow.

Hong Kong’s Securities and Futures Commission (SFC) already allows managers to sell crypto futures ETFs, which are deemed less volatile than investing in the spot market. The city authorities then stated that retail investors would be able to buy funds to invest in spot crypto. Now, the city is ready to spot Bitcoin ETFs.

Bosera Asset Management, the Hong Kong arm of a Chinese fund manager, is among those that have applied to launch a Bitcoin ETF in the city, as per Nikkei Asia. If their application gets approved, the product will be co-managed by HashKey Capital, which is the sister company of the licensed retail-facing crypto trading platform HashKey Exchange.

Two more fund managers with Chinese shareholders, Harvest Global Investment and Value Partners, have reportedly applied to launch a similar product. A local media outlet also reports that China Asset Management (Hong Kong) has applied for the same.

These funds are expected to open the gates to a huge flow of capital from family offices and hedge funds as well as mainland Chinese investors, who are banned from trading crypto. However, despite the ban, cryptocurrencies remain popular in the country, with buyers making use of underground markets and overseas bank accounts to purchase crypto.

So, as Chinese investors explore ways to store their wealth, they have been investing in gold, which led to authorities halting trading of gold-linked ETFs after its price climbed to a 30% premium. Now, with the approval of ETFs, a similar momentum could be expected in digital gold.

According to Singapore-based 10x Research founder Markus Thielen, these ETFs could trigger a Chinese retail buying frenzy similar to the one recorded in the 2013 bull market.

According to Adrian Wang, the chief executive of the Hong Kong-based crypto wealth manager Metalpha, “The significance of Hong Kong ETFs is far-reaching as it could bring in fresh global investment as well as pushing crypto adoption to a new height.”

While Hong Kong regulators have accelerated their approval process for spot bitcoin ETFs, other countries like Australia, Singapore, and the UAE are also showing interest in similar offerings. Meanwhile, it is believed that nations such as Japan and the UK might introduce policies aimed at curbing the transfer of cryptocurrency funds to other regions.

After BTC, Could Ether Spot ETF be Next? Doubts Arising

Coming back to the US, ever since the Bitcoin Spot ETF got approved and enjoyed a boost in its price, the market has been looking at Ethereum as the next proponent to get an ETF.

The mainstream financial institutional giants BlackRock, Fidelity, and VanEck have also filed for Ethereum ETFs. This includes Grayscale, which now seeks to convert its Ethereum Trust (ETHE) into an ETF after winning the case against the SEC to re-examine its GBTC conversion to ETF rejection decision. This ultimately paved the way for Bitcoin Spot ETF approvals in January.

“We’re optimistic that the SEC will be on the right side of history here and also permit those products to come to market.”

– Sonnenshein

The SEC is to rule on these applications by May-end after delaying the original March deadline.

While there was much excitement and optimism in the market about the Ether ETF approval, it is starting to come down for a number of reasons.

For one, the regulator has signaled that it might not be happening, with SEC Chairman Gary Gensler previously emphasizing that “the vast majority of crypto assets are investment contracts and thus subject to the federal securities laws.”

Recently, the SEC also started investigating companies associated with the Ethereum Foundation, a Swiss-based non-profit organization (NPO). The organization has stated on its website’s GitHub repository that it received a “voluntary enquiry from a state authority that included a requirement for confidentiality.”

As such, pessimism about the potential approval is creeping in, with Jean-Marie Mognetti, CEO of European asset manager CoinShares, saying:

“I don’t see anything being approved this side of the year.”

He further noted that it may be difficult to obtain regulatory approval for a proof-of-stake (PoS) blockchain as opposed to Bitcoin’s proof-of-work (PoW) blockchain.

Meanwhile, in an interview with CNBC during a crypto event in France, VanEck CEO Jan van Eck said that the asset manager and Ark Invest were the first ones to file for an Ethereum ETF application and “kind of the first in line for May, I guess, to probably be rejected.”

Van Eck explained why he believed so. The legal process for the ETF involves regulators giving issuers comments on their application weeks in advance. But “right now, pins are dropping as far as Ethereum is concerned,” he added.

Doubts are springing not just within the crypto sphere but also outside the space, with JPMorgan saying that the SEC will reject the applications at the upcoming deadline next month. However, they do see the approval likely after this rejection, which will result in litigation, leading to a legal battle that the agency will lose, much like it did last year against Grayscale and Ripple.

The price of Ether has also been struggling. It is currently trading at $3,514, up about 54% year-to-date (YTD) and 126.7% in the last six months. Eth’s price has yet to hit a new ATH and remains 28% off its $4,880 peak from Nov. 2021. Additionally, the ETHBTC ratio has dipped under 0.050 and has been on a downtrend since Sept. 2022.

Is Litecoin ETF Coming Then? Rumor Mill in Full Swing

While Spot Ethereum ETF’s chances are diminishing, the market is speculating that other altcoins might get a taste of fresh capital instead. Rumors are abound that Litecoin may be next in line for a potential spot ETF.

This all started when Fox Business journalist Eleanor Terrett posted a scoop on X (previously Twitter) about potential institutional interest in this altcoin, which is based on the Bitcoin protocol. Terrett’s post read:

“Hearing rumblings on the institutional level about possible interest in a Litecoin ETF. The logic is that because of LTC functional similarities to BTC, the SEC may be more inclined to approve it, possibly even more so than ETH.”

He further pointed out Coinbase Derivatives’ recent actions involving launching futures contracts for Litecoin, Bitcoin Cash (BCH), and Dogecoin (DOGE) with a size of 5 LTC, 1 BCH, and 5000 DOGE.

On April 11th, the CFTC-regulated futures exchange announced that with these crypto futures contracts, Coinbase Derivatives aims to provide retail traders with opportunities for price discovery, diversification, margin, and risk management. The launch earlier this month, the exchange said, has led to deeper and tighter markets by allowing traders to participate with reduced upfront capital requirements and within a regulated framework.

Even the Litecoin Foundation has added fuel to the fire with its Managing Director, Alan Austin, saying:

“Love or hate ETFs, the first company to launch a Litecoin ETF is going to crush it!”

As a result, the price of LTC surged from about $78 on March 20th to over $110 on April 1st, representing an increase of over 41%. Although the price remained above $100 until early this week, it has since fallen, and at the time of writing, it is trading at $95.90. Despite the recent interest and price spike, Litecoin is still a significant 76.6% below its May 2021 high of $410.26.

Crypto market participants believe and hope that we may see other altcoins get an ETF, particularly those that are not classified as securities by the SEC, especially if Ethereum ETF gets approved.

With regular hurdles putting roadblocks in Ethereum’s path to an ETF, market enthusiasts are looking at even XRP. Steven McClurg, CIO at Valkyrie Funds, who has also expressed his doubts on Ether’s ETF chances with the agency seeing ETH as a security, said Litecoin and XRP ETFs could be approved sooner, given SEC’s views on these cryptocurrencies.

Meanwhile, Martin Hiesboeck, Head of Research at crypto exchange Uphold, said that XRP ETF might be around the corner. The altcoin’s value jumped past $0.73 last month but is now back at under $0.6, down 82.5% from its Jan 2018 peak.

Concluding Thoughts

As we saw, the Bitcoin Spot ETF has been a roaring success in the US, and this momentum could continue in Asia with Hong Kong poised to approve spot ETFs. With that, Bitcoin’s price, which has been resting around $70,000, may get the push to make new ATHs and potentially hit $100,000.

Another big event for Bitcoin is the upcoming halving, which will come in less than ten days. Historically a bullish event, the price of BTC might not be ready to fly off just yet given that it has been rallying for the last six months. Not to mention, this is the first time that the BTC price has hit an ATH before the supply shock event.

However, the fact that the largest cryptocurrency’s supply growth will be cut by half while demand for Bitcoin has been strong and growing speaks well for its price. Having said that, in the short term, it’s to be seen just which way Bitcoin’s price moves next, and by extension, altcoins.

Click here to read about the next region that could see Bitcoin ETF approval next.