Best AVAX DApps 2024: Exploring the Avalanche Ecosystem

Avalanche is a lightning-fast and scalable blockchain platform that empowers developers to build without limits. It offers advanced tools for quick and easy deployment of Web3 innovations, ensuring that projects can go from idea to launch in under 60 seconds.

İçindekiler

One of Avalanche’s key features is its innovative architecture, including subnets, which set a new standard for scalability while maintaining speed, reliability, and security. These subnets create a network of interconnected yet independent blockchains, ensuring that performance and security are not compromised even as the platform scales to accommodate more users and transactions.

In this article, we will take you on a tour through the Avalanche ecosystem and highlight the best AVAX DApps.

Understanding Avalanche

Avalanche is an open-source platform catering to the launch of decentralized finance (DeFi) applications and enterprise blockchain projects within a unified, highly adaptable ecosystem. Operating on a proof-of-stake mechanism, Avalanche enables tens of thousands of validators to actively participate in decision-making processes while maintaining minimal energy consumption.

At the core of Avalanche lies its Snowman consensus protocol, a totally-ordered and linear protocol designed for specific applications on the platform to ensure precise execution and sequencing.

Ava Labs, the developer of Avalanche, was founded by researchers and engineers from Cornell University, along with talent from Wall Street, with the goal of creating an open-source platform for decentralized applications (DApps) and enterprise blockchain projects.

The company has received funding from Andreessen Horowitz, Initialized Capital, and Polychain Capital, with angel investments from Balaji Srinivasan and Naval Ravikant.

To learn more, you can head over to full Avalanche review.

Best AVAX DApps

Before we begin, it’s important to note that the following isn’t meant to be a ranking of any sort. Instead, our goal is to highlight the diverse Avalanche ecosystem.

BENQI

BENQI is a non-custodial liquidity market protocol that allows users to lend, borrow, and earn interest with their digital assets. It is the largest protocol on Avalanche.

BENQI has three components:

- BENQI Markets facilitates lending, borrowing, and interest-earning with digital assets. It operates on a permissionless model, allowing users to instantly supply or withdraw liquidity and borrow in an over-collateralized manner. The platform offers real-time interest rates based on market supply and demand.

- BENQI Liquid Staking provides a solution for tokenizing staked AVAX, enabling users to freely transfer locked-up capital, utilize their yield-bearing assets in DeFi applications, and stake AVAX on the Avalanche Contract Chain without cumbersome cross-chain transfers.

- Ignite serves as a protocol for bootstrapping Avalanche validators and Subnets, catering to a broad range of users from institutions to individual developers. It offers a permissionless approach, enabling users to launch validators with minimal capital and affordably launch blockchains to support innovative Web3 ideas.

Turning to numbers, BENQI has $271.5 million worth of AVAX staked. It is currently offering an annual percentage rate of 5.74%. Also, there are currently no fees for staking and unstaking AVAX on BENQI Liquid Staking.

QI is the protocol’s native token. It can be staked for a utility token called veQI, which grants Avalanche validators additional AVAX delegations from BENQI Liquid Staking. The total supply of QI is 7.2 billion tokens.

As of April 25, BENQI’s total value locked stood at $338.7 million — roughly a third of Avalanche’s total TVL, according to DefiLlama.

Roco Finance

Roco is a decentralized GameFi platform built on the AVAX network, offering blockchain services to game developers, content creators, and player communities. With a focus on driving innovation in online gaming, Roco aims to empower promising gaming projects through industry-specific solutions.

The platform implements the “play and earn” philosophy, allowing players to earn crypto assets within games and trade virtual items on the NFT market. This bridges the gap between virtual and real-world assets, allowing players to bring their in-game earnings into the real world and vice versa.

Roco provides NFT services for the management, distribution, and exchange of virtual items, facilitating transactions over the blockchain network. Additionally, it creates staking and farming pools for partner gaming companies, enabling them to manage and reward their players. Token holders can also earn rewards by staking their tokens.

Roco offers open-source SDKs, APIs, game add-ons, and virtual item management applications. Through Roco Starter, it supports promising game projects in their seed and incubation stages by organizing initial DEX offerings (IDOs) and providing technical support.

The protocol’s native token is ROCO. Token holders:

- Can stake their tokens to generate yield.

- Have priority participation in IDOs at Roco Starter.

- Can earn airdrops from partner game tokens.

If you’re looking to buy ROCO, you can do so via Gate.io, HTX and MEXC. Pangolin, Trader Joe and YetiSwap are the only decentralized exchanges where the token can be bought.

Crypto gaming’s play-to-earn mantra is considered a major hurdle to widespread adoption. Our article explores that, as well as what lessons Web3 gaming can glean from Web2, and much more.

FerdyFlip

FerdyFlip is a decentralized casino operating on Avalanche, Base, and FerdyNet (Avalanche Subnet Testnet). It offers users a platform without KYC requirements, providing instant settlements and revenue-sharing NFTs.

FerdyFlip allocates 1% of all bets across all supported chains towards Ferdy Fish NFT holders. These holders are eligible to claim a portion of this revenue based on the number of NFTs they own. This 1% revenue share is derived from bets made on all chains and is redistributed to the collection holders specifically on the AVAX chain.

Roughly $8.6 million has been wagered on the platform across over a million bets. The average bet size is $53.79, while the most someone has bet is over $36,000.

The FerdyFlip roadmap outlines several key initiatives:

- Introduction of FERDY token: Shifting from a limited set of 300 NFTs to a token model to broaden revenue-sharing options and facilitate a more liquid market for stakeholders. The FerdyFlip team will sustain funding through casino profits by staking their token share.

- Exploration of dynamic NFT value transfer mechanisms: Investigating ways to enhance the functionality of Ferdy NFTs post-transfer to increase their value.

- Chain expansion: Extending operations to additional EVM chains such as Arbitrum and Optimism, with plans for expansion to non-EVM chains like Movement, Aptos and Sui.

- FerdyChain development: Exploring the creation of a custom chain on Avalanche to optimize gambling experiences by enabling instant validator-generated RNG.

- Multiplayer/PVP integration: Introducing more multiplayer games, starting with simple ones and potentially expanding to complex games like Poker.

OrderNChaos

OrderNChaos is a twin system of algorithmic stablecoins that introduces two tokens:

- CHAOS, an algorithmic metastable token serving as a store of wealth

- ORDER, a decentralized superstable store of value

The protocol enables zero liquidation-risk loans of ORDER with a negative interest rate, allowing users to earn a yield on their debt. This is achieved by leveraging the volatile energy of CHAOS to back the stable ORDER token.

The ORDER token consolidates liquidity from diverse stablecoin reserves into a single token. CHAOS maintains intrinsic value backed by diverse reserve assets, ensuring a hard floor price below which it cannot trade. As the surplus reserves grow, the protocol algorithmically increases the intrinsic value of CHAOS, resulting in gains for holders.

Users are incentivized to stake CHAOS to earn rewards in pre-CHAOS (prCHAOS) tokens, creating compounding APY for stakers. Additionally, CHAOS can be used as collateral for zero liquidation-risk ORDER loans, as ORDER is fully collateralized 1:1 with the intrinsic value of CHAOS.

This system, the company said, provides a sustainable and efficient approach to algorithmic stablecoins and decentralized finance on the Avalanche network.

DexPad

During the 2017 Bitcoin rally ICO boom, many startups entered the market through presales, aiming to raise funds for their projects. However, challenges such as a steep learning curve in Solidity, lack of security and not enough trust from initial presale investors forced many startups to close shop.

DexPad aims to ensure that doesn’t happen again.

Here’s how DexPad solves the issues:

- Simplified Token Launch Process: DexPad automates the token launch process, making it easier for startups to mint their tokens and conduct presales. By eliminating the need for complex Solidity programming, DexPad opens up ICO participation to a wider range of projects.

- Governance Protocol for Audits and Decision-Making: DexPad implements a governance protocol where proposals are submitted and voted on by the community. This ensures transparency and allows stakeholders to have a say in key decisions such as token audits, fee structures, and further development.

- Anti-Scam Mechanisms: DexPad incorporates anti-honey pot mechanisms to prevent exit scams. By enhancing security and transparency, DexPad builds trust among investors and reduces the risk of fraudulent activities within the ecosystem.

- Instant Liquidity Listing: DexPad facilitates instant liquidity listing on major DEXs across multiple blockchain networks. This mitigates the risk of rug pulls and provides liquidity for newly launched tokens, enhancing investor confidence.

The protocol’s native token is DxP.

Ante Finance

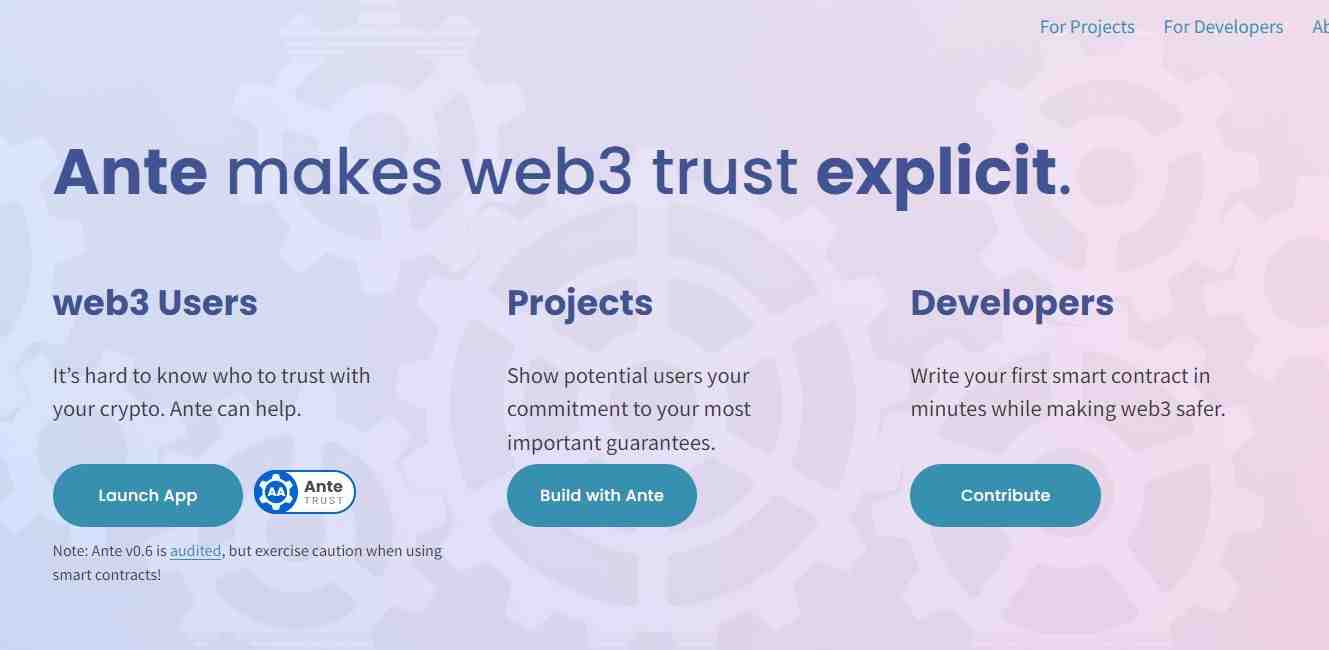

Ante is a decentralized protocol designed to translate implicit trust assumptions, like the solvency of a protocol or the trustworthiness of a development team, into explicit on-chain commitments called Ante Tests. These tests are publicly verifiable and staking them gives credibility, with payouts happening in the event of test failure.

These trust-signalling primitives pave the way for a decentralized trust ratings system, enhancing safety for both builders and users in the Web3 space.

Security experts can monetize their expertise by identifying flawed tests or broken invariants and challenging the corresponding Ante Pools. In the event of a test failure, funds staked in Ante Pools are distributed pro rata to challengers, with a bonus for the initiating challenger. Challengers’ balances undergo ongoing decay, claimable by stakers pro rata.

By making implicit trust explicit, Ante facilitates smarter building in Web3, akin to turning Jenga blocks into LEGO bricks. It allows project teams to credibly signal commitment to trust guarantees, enables users to compare projects based on verifiable trust scores, encourages new developers to deploy their first smart contracts, and incentivizes security experts to identify flaws and enhance Web3 safety.

Ante has been audited for security and it does not have a token.

Where to Buy AVAX

To acquire Avalanche’s native token (AVAX), users have several options available through various cryptocurrency exchanges. Popular exchanges like Coinbase, Kraken, and Bybit offer AVAX trading pairs, allowing users to purchase AVAX using fiat currency or other cryptocurrencies. Also, check out our picks for the best crypto exchanges.

Alternatively, DEXs such as PancakeSwap, Dexalot and Uniswap let you swap stablecoins like USDT or USDC for AVAX tokens. DEXs offer a decentralized approach to trading without the need for Know Your Customer (KYC) verification. However, users should have a basic understanding of cryptocurrency and decentralized platforms to navigate DEXs effectively. Looking for the best decentralized exchanges? Look no further as we cover the top DEXes on different protocols in our in-depth guide.

When choosing an exchange, users should consider their specific needs and preferences. Centralized exchanges offer convenience and may be more suitable for beginners, but they often require KYC verification, which compromises privacy to some extent. On the other hand, decentralized exchanges prioritize privacy but require users to understand the nuances of interacting with decentralized platforms.

Best AVAX DApps: Closing Thoughts

Avalanche is a fast and scalable blockchain platform that empowers developers to build without limits. With its innovative architecture, Avalanche offers advanced tools for quick and easy deployment of Web3 innovations, ensuring projects can go from idea to launch in under 60 seconds.

Within the Avalanche ecosystem, we’ve explored a diverse range of top DApps that showcase the platform’s capabilities and potential. From decentralized finance protocols like BENQI to gaming platforms like Roco Finance, each DApp leverages Avalanche’s speed, reliability, and security to provide solutions and opportunities.

Additionally, projects like FerdyFlip, OrderNChaos, DexPad, and Ante Finance address specific challenges within the blockchain space, ranging from decentralized gambling and algorithmic stablecoins to token launch platforms and trust verification protocols.