Bitcoin and Ethereum Price Analysis: BTC and ETH Options Activity Surges To $20B

Table of Contents

According to Deribit, the combined notional open interest in Bitcoin and Ether options listed on the platform has surged to a historic high of $20 billion.

İçindekiler

Options worth $4.5 billion expire on Friday. Growing interest in options is a sign of market sophistication.

Options Activity Surges

According to data tracked by Swiss-based Laevitas, the notional open interest of the dollar value locked in active Bitcoin and Ether options contracts on Deribit has risen to a staggering $20.64 billion. This figure mirrors the peak registered on the 9th of November, 2021, when Bitcoin was trading above the $66,000 mark. This is nearly 90% higher than the current rate of $34,170. Simply put, the current open interest in contract terms is considerably higher than in November 2021. The Chief Commercial Officer at Deribit, Luuk Strijers, stated,

“The milestone has been achieved with nearly double the number of outstanding contracts, representing not just a substantial triumph for Deribit but also a clear indicator of the broader market growth and the escalating interest in options among our clients.”

Deribit currently controls 90% of the global crypto options activity. Options are derivatives contracts that give the purchaser the right to buy or sell an underlying asset at a predetermined price on or before a specific date. However, the purchaser is not obligated to buy or sell the asset. A call option gives the right to buy, while a put option offers the right to sell. A call buyer is bullish on the market, while a put buyer is bearish.

What Does This Record Activity Indicate?

The record activity indicates that flows in the options market tied to investors, and market makers will have more say when determining the spot market price. Market makers were set to hold a net short gamma exposure in Bitcoin and may have bought the cryptocurrency as it rose in value to adjust their overall exposure back to neutral. This may have inadvertently accelerated the price rally. Bitcoin’s price has surged over the past couple of weeks, rising above the $34,000 level.

Around 08:00 UTC, BTC and ETH options contracts worth $4.5 billion are set to expire on Deribit. These monthly and quarterly settlements are known to bring volatility into the crypto markets.

“Options worth $4.5 billion will expire on Friday. That’s a particularly high value of which an uncommon percentage is set to expire in the money (ITM) due to the recent market move potentially prompting some market action.”

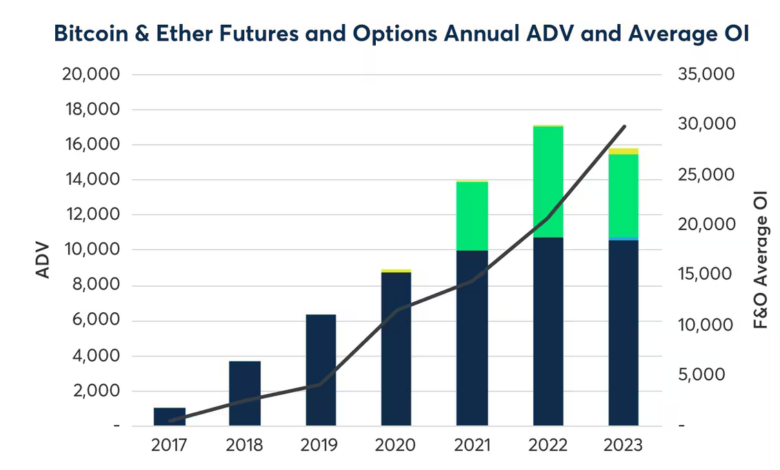

CME Reports Q3 Open Interest For BTC, ETH Derivatives At All-time High

The CME Group, operators of the Chicago Mercantile Exchange, have said that volumes and open interest for crypto derivatives have significantly increased in the third quarter of 2023. With the ongoing rally, CME stated that Monday’s trading session set a record for CME Group Bitcoin Futures at 20,000 contracts. However, the group believes that Monday, which saw Bitcoin go from $30,500 to nearly $35,000, was no fluke.

The third quarter also set a record average of 15,800 contracts for bitcoin futures. This is up nearly 11% from the previous quarter. Meanwhile, open interest for Ether futures saw a 22% jump from the 2nd quarter. Meanwhile, Ether options contracts have seen a significant jump in the third quarter, increasing by 75%, while open interest rose by 55% on a quarterly basis.

“While volatility and prices have remained mostly range bound along with trading volumes this year, CME Group continues to see increases in open interest across the Cryptocurrency suite.”

Bitcoin And Ether Price Action

Bitcoin’s price has breached the $30,000 resistance and is experiencing considerable upward momentum. If we look at the daily chart, it is obvious that the price has experienced a considerable rally subsequent to its breakout from the 200-day moving average, which is around the $28,000 mark. The resistance at the $30,000 level has also been conquered, signaling a new bullish phase.

At the same time, the Relative Strength Index (RSI) is exceeding 70%, signaling that the asset is overbought. This could be read as a bearish indicator and hints at potential consolidation in the short term.

Meanwhile, Ethereum had a reasonably good week, registering a 12.3% price increase. In doing so, it also got back into the ascending triangle, a bullish indicator. If the momentum continues, ETH has an excellent chance of reaching the resistance at $2100. Currently, the support is found at $1665.

Disclaimer: This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.