Ether Options Indicate Bearish Sentiment Amid Bullish Predictions

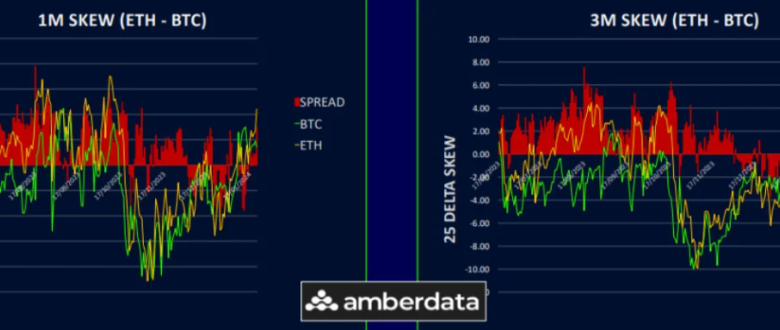

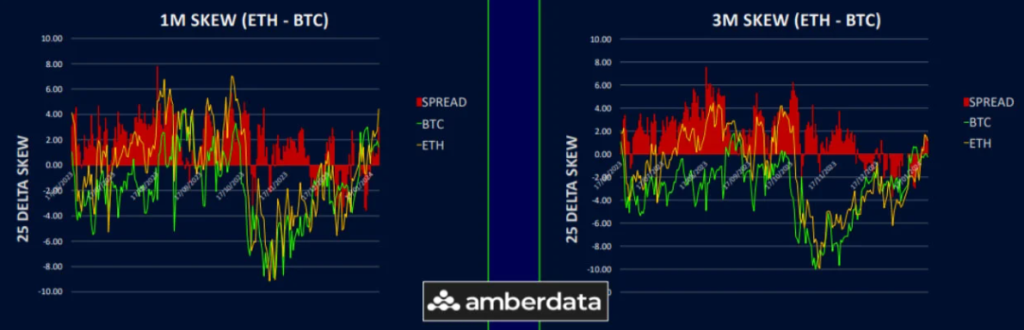

Amberdata, a well-known company that tracks cryptocurrency information, says that options connected to Ether show a leaning toward expecting lower prices in the next 3 months. However, there’s a slight hint that there might be some strength in the months that come after.

One-Week Call-Put Skew Hits 3-Month Low

On Wednesday, the one-week call-put skew for Ether, which gauges the demand for calls compared to puts expiring in seven days, reached nearly -8. This marks the lowest level observed in over three months and indicates a prevailing inclination for bets anticipating a decline in Ether’s

Meanwhile, the way people are betting on the price of ETH has changed a lot. In the short term, more people are making bets that the price will go down, especially until April. But for the longer term, there are still many who believe the price will go up.

As of the latest data, the skew remains negative, with one-, two-, and three-month skews all displaying a negative outlook.

Cautionary Short-Term Outlook

Imran Lakha, founder of Options Insights, highlighted the sudden increase in ETH skew, linking it to the influence of call selling flows and the breach of key technical support at $2,400. Lakha emphasized the critical level for ETH at $2,150, suggesting that breaking this level could lead to further declines.

However, the recent market movements indicate a cautious short-term outlook for ETH, with growing demand for hedging strategies.

As of the latest data, Ether is trading at $2,220, reflecting a 1% drop for the day. These dynamics within the options market add a layer of complexity to the overall sentiment around Ether, leaving investors to navigate the contrasting signals in their decision-making process.