Home Ownership is More Prohibitive than Ever Before in North America – Can 3D Printing Change This?

Homeownership, A Fading Dream?

Rising prices and rising interest rates in the last few years have made homeownership increasingly difficult to achieve. This is especially true for the younger generations like millennials (born between 1981 and 1996) and Gen Z (born from 1997 to 2012).

İçindekiler

The problem is compounded by inflation, rising population, growing inequalities, and a limited supply of new housing.

This is a global phenomenon, especially acute in the “Anglosphere”, and now widely recognized as a problem:

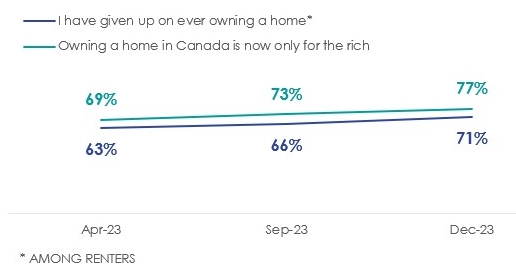

71% of renters in Canada say “I have given up ever owning a home” in December 2023, up from 63% in April 2023.

Source: IPSOS

Meanwhile, 2/3rd of young people are giving up on home ownership in Australia,

In Sydney and Melbourne, since 2005, the median house price has climbed 3.5 times the inflation rate and 2.5 times the increase in average weekly earnings.

The Sydney Morning Herald

And 61% of American renters said they are worried they will never be able to own a home.

Source: The Guardian

It Wasn’t Always Like That

This situation is rather unique to our time period, and previous generations faced a very different housing market.

This is easily demonstrated by flash interviews like in this video, where older people answer the question “How expensive was your first house?”. And the answers range are $16,000, $26,000, and $37,000.

Of course, such amounts need to be adjusted for inflation. But since the 1970s, housing has consistently been rising quicker than overall inflation, making the real estate market more and more expensive.

Source: CUtoday

This creates a situation where the entry point and down payment on a home keep rising higher and higher, quicker than savings and salaries rise can keep up with.

Since 1985, US housing prices have gone up 5.5x, while median household income went only up 3.3x.

Source: Visual Capitalist

The same is true in the UK, where average property prices have risen twice as fast as wages in the UK over the past four decades.

“Policy missteps over the past three decades have contributed to a situation that is undermining the living standards of future generations.

I don’t understand why younger people today aren’t out on the streets, protesting against their parents and their grandparents for what they’ve done to the cost of housing in this country,”

Independent economist Saul Eslake – The Sydney Morning Herald

Of course, in addition to the disparity between the rise in housing prices and income, there is added disparity in the job market, where young people are in a very different job market than baby boomers at the same age and are more likely to struggle with unemployment, student debt, need more diplomas and experience for the same jobs.

Why Did This Happen?

There is no clear-cut explanation of why the housing market has spiraled out of control that much.

But there are a series of factors that contributed to the current dire situation.

Increased Sizes

One comment often made by older people about the housing market is that modern homes are more expensive because they are a lot nicer than houses in the 1970s.

And to be honest, there is some truth to that. Modern houses tend to be better equipped, notably with central heating and air conditioning.

They are also, on average, much bigger.In 1970, the average square footage of a house was 1,500 square feet (up from 1,048 in 1920) and was 2,014 in 2023.

Not Enough Building & Increased Regulation

Another factor in rising housing prices has been an increase in the cost of building them. Building activity has been too subdued to answer demand, and this is largely due to increases in land prices and increased regulations.

While regulations are needed for new buildings to be safe, new regulations have overall increased the cost of design, approval, labor, and maintenance of housing.

Many zoning laws and housing rules are specifically designed to avoid the construction of affordable dense urbanism needed to push prices down. And this happened because it overall benefited a lot of powerful interests, from real estate developers to politicians to existing homeowners.

Home As An Investment

A shift in perception occurred since the 1970s, with housing increasingly seen as an investment vehicle more than a place to live in.

“Homes were increasingly built and sold to existing homeowners seeking an additional home solely as a retreat or asset rather than a residence.

Overall, second-home buying could explain about 30 percent and 10 percent of the run-up in construction employment and house prices, respectively, from 2000 to 2006.” – Daniel Garcia, Federal Reserve economist

Today, this situation is compounded by the arrival in the housing market of massive money flow from Wall Street investment firms like Blackrock buying collectively hundreds of thousands of houses.

Previous generations have also often failed to prepare for retirement by saving and investing in assets besides their main residency, or a few extra housing units they rent out. This accumulates to a total of $18T worth of housing owned by baby boomers. As a result, they are also by far the richest generation.

Source: A Wealth Of Common Sense

So, it is no surprise that the baby boomers have consistently voted nationally and locally for regulations and laws that have kept the housing market rising.

Politicians still remembering the fallout of the housing bubble briefly deflating in 2008 are reluctant to tackle the problem.

We should also note that this problem of speculation making housing unaffordable is not a uniquely Western problem.

Most recently, China’s government has been actively trying to pop its own housing bubble in a controlled fashion, with the economic consequences yet to be determined.

“House is for living not speculation”. – Xi Jinping – China’s President

Between the risk of crashing the economy or unaffordable housing, it is a difficult choice to make.

Monetary System

While it is easy to blame an entire generation, things may be a little more complex than that.

The 1970s were a turning point in economic history. In 1971, Nixon decided to leave the gold standard. This was the trigger for several decades of growing inequality, an explosion in international currency crises, a steady rise in government debt, etc.

Source: WTF happened in 1971

So, the decline in housing affordability should most likely be better understood in the broader context of inflation and monetary system changes.

Maybe baby boomers were only lucky to be born at the right moment, more than responsible for these changes.

Consequences Of Impossible Home Ownership

The issues created by an increasingly out-of-reach housing market are many and threaten the very stability of our societies.

Life As A Struggle

Younger people unable to ever buy a home are vulnerable to rent increases out of their control. They are unable to use homeownership as a tool to accumulate capital, the way baby boomers did.

They are also more vulnerable to rent increases, financial struggles, and even homelessness in case they lose their job.

All of these conditions make for poor mental health and limit millennials and Gen Z’s ability to take financial risks like entrepreneurship. It also delays family formation or makes it outright impossible, causing a serious demographic decline.

Divisions And Populism

The struggle for housing is not equally shared. We mentioned the generational divide, which can split families and reduce social cohesion.

It is also a racial divide, with non-white people more likely to struggle with housing affordability.

Source: The Guardian

At the same time, the lack of housing makes welcoming immigrants difficult, as every newly arrived immigrant is a home renter or potential buyer putting pressure on the already insufficient housing supply.

Altogether, this creates a fertile ground for all kinds of populist politics and combines with the other concurrent issues of inequality and discrimination.

Changes & 3D Printing Homes

Because the housing crisis stems from so many causes, there is no silver bullet to solve it. However, the growing acceptance that there is a problem is encouraging. The growing demographic and electoral weight of millennials and Gen Z should also have an impact.

For example, in 2022 Canada passed the Tax-Free First Home Savings Account (FHSA) to aid Canadians with savings for purchasing their first home. We discussed further for our Canadian readers how to take maximum advantage of this measure in our article “What is a Tax-Free First Home Savings Account (FHSA) in Canada?”.

Besides societal and political changes, technology could help as well. Until now, construction has been a very labor-intensive process, making it mostly immune from productivity gains like in manufacturing. This is about to change with the emergence of 3D-printed constructions.

The concept is to apply to masonry 3D printing principles:

- Material can applied into the desired shaped nozzle.

- The process is mostly automated and computer-controlled, which can work 24/7 with limited labor input.

- Design can be entirely digital and transferred directly to a physical medium.

Currently, the main concept is using cheap materials like concrete, and building the way a 3D printer does with plastic filament or metal.

Source: Cornell University

By doing so, 3D printing can save weeks or months of construction time. The system requires a temporary frame for the 3D printing nozzle, just very much oversized compared to other 3d printers.

Source: Cornell University

It is also easy to imagine that 3D printing could, in the future, be combined with other methods for automated production. For example, CNC wood carving, and maybe at some point automated assembly by robots.

The idea of 3D-printing houses is also meeting emerging trends, such as building cheap, smaller entry houses that can be afforded by younger generations and single-person households.

For example, the company Icon (see more below) produced a prototype 350-square-foot tiny home that cost $10,000 and took just 48 hours to build, and might improve their method to build a 2,000-square-foot home for only $20,000.

Together with factory-made housing kits for houses, other automation solutions, and the tiny houses movement, 3D-printed houses could be a cornerstone of market-driven solutions to the current affordability crisis, especially if it is combined with more lax future zoning and building regulations.

And more importantly, by helping first-home owners to save on rent, help them build up financial independence.

Home 3D Printing Companies

1. COBOD

Cobod is a pioneer in 3D-printed buildings and has already sold 50 printers globally since creating its first prototype villa in Dubai in 2019.

COBOD benefits from a strong brand and a lead into the race for commercialization of 3D printed manufacturing for construction, which might be crucial for adoption in an industry often slow in adopting new technology.

The massive printing frame can print up buildings infinitely long, up to 14.6m/48ft wide, and up to 8.5m/28f feet.

It also comes with a standardized batch plant, silo, and pump to mix the mortar and cement on-site with full digital integration.

Source: COBOD

2. ICON

ICON is another housing 3D printing company, with a focus on advanced robotics and materials.

Source: ICON

Notably, it developed its Phoenix robotic arm, able to build not only the walls but also the foundations and the roofs of buildings.

The reduced setup time and number of operators allow for costs to be cut by half, reaching $25/square foot for wall systems or $80/square foot including foundation and roof.

Source: ICON

The company is also working with CarbonX, a proprietary formula allowing for ICON’s building to be the “ lowest carbon residential building system ready to be used at scale”.

Another remarkable achievement of ICON has been to be selected by NASA for Project Olympus, a $57.2M contract for a 3D printing system to create on the Moon landing pads, roadways, non-pressurized structures, and pressurized habitats, using local regolith (Moon dust) instead of imported from Earth materials. The same method could be used for Martian habitats as well.

Source: ICON