May Crypto Madness Recap: All the Excitement & Turbulence That Hit the Market

2024 started on a good note with the approval of the Spot Bitcoin ETF that sent BTC to new highs in March and helped the market rejoice with greens. However, after recording a 68.6% upside in Q1, Q2 has turned red two months in.

İçindekiler

Bitcoin”s 2Q24 returns are currently at -5.12% despite posting a green May at 11.3% after recording a 14.7% decrease in its price in April, as per CoinGlass. The total crypto market cap, meanwhile, is ending May at $2.66 trillion after starting the month at $2.29 trillion.

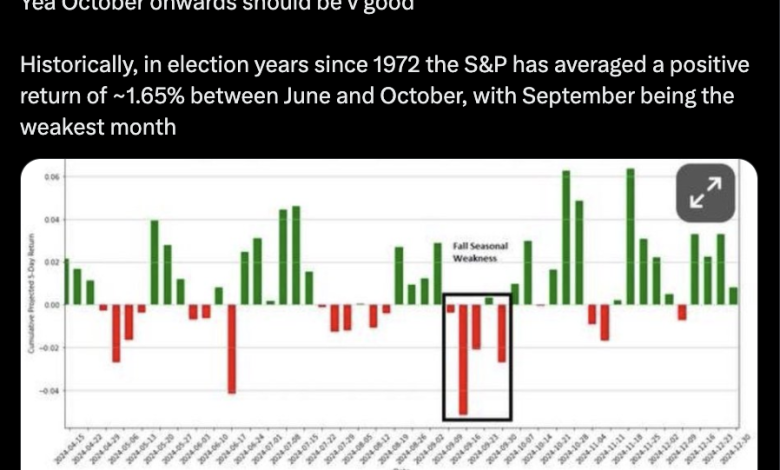

May has been a volatile month when it comes to prices, but market participants are expecting the coming months to be rather uneventful. Prices are expected to range throughout summer before seeing action at the end of the year when the 2024 US Presidential election will reach its crescendo.

While May has been decent in terms of price and activity, upcoming months might not be as good as Kaiko stated, “trading activity typically slows down and liquidity dries up over the summer months.”

For now, Bitcoin continues to trade around $68K while the sentiments remain that of greed based on a 73 reading as per the Crypto Fear and Greed Index.

Meanwhile, open interest (OI) in Bitcoin futures has gone up from $29.3 bln at the beginning of May to $34 bln. For the largest crypto asset by market cap, CME is in the lead at $10.19bln, followed by Binance ($7.60bln) and Bybit ($4.95bln).

However, a big challenge for the crypto king is the large amount of Bitcoin to be released by Mt. Gox which will finally hit the market for selling. This week, for the first time in five years, the now-defunct exchange transferred assets out of its cold wallets to a single BTC wallet.

Once the world’s largest Bitcoin exchange, the Tokyo-based Mt. Gox lost over 800,000 BTC in a hack and then declared bankruptcy in 2014. All this time, creditors have been waiting for the repayment, which seems to be finally in sight. The repayment deadline is currently October 31st, 2024. So, the latest movement might be part of an asset distribution plan.

Crypto in Political Crosshairs

With crypto becoming a major political issue, the upcoming quarters can be exciting ones for Bitcoin and altcoin prices as both the presidential candidates, Donald Trump and Joe Biden, change their stance on crypto in a sudden move to sway undecided voters in their favor.

In the last couple of weeks, ex-US president Trump has vowed to protect people’s right to self-custody Bitcoin and stop Biden’s “crusade to crush crypto.“ His campaign is now also accepting crypto donations, and his crypto holdings have surpassed $10 mln, including TRUMP, ETH, MVP, CONAN, and BABYTRUMP.

Trump also promised to free Ross Ulbricht, the founder of Silk Road, and not allow the creation of a central bank digital currency (CBDC). This changed stance has many seeing Trump’s potential return to the White House as “broadly positive“ for the crypto industry.

However, Trump is not alone in this pivot. Biden’s re-election campaign has also started reaching out to cryptocurrency industry players and is seeking guidance on “crypto policy moving forward.“ The engagement efforts initiated just a few weeks ago followed the Biden administration’s recent announcement to veto the repeal of SAB 121. This legislation discourages financial institutions from providing custody services for cryptocurrencies, a position that has been met with criticism from crypto advocates.

Additionally, last week saw the bipartisan passage of the Financial Innovation and Technology for the 21st Century Act (FIT21) with a vote of 279-136. This bill seeks to create a new legal framework for cryptocurrencies, assigning regulatory oversight to the CFTC.

President Biden opposed FIT21 along with Gary Gensler, the Chairman of the US Securities and Exchange Commission (SEC), who argued that the bill not only creates “new regulatory gaps“ but also undermines “decades of precedent regarding the oversight of investment contracts“ on the blockchain.

May marked a significant month for the cryptocurrency space as it became a major topic in political discussions due to upcoming regulations. A Grayscale survey showed that 47% of 1,768 adult respondents who plan to vote in the next Presidential election expect to have cryptocurrencies in their investment portfolios, an increase from previous figures. Meanwhile, 44% of voters who do not yet own cryptocurrency are waiting for further regulatory clarity before making any investments.

There are clear shifts in interest and perception, and the launch of Spot Bitcoin exchange-traded funds (ETFs) is driving this interest. According to the survey, nearly one-third of voters became more interested in crypto as an asset class after the SEC approved the ETF in January.

BlackRock’s IBIT Overtakes GBTC

Ever since the launch of ETFs less than five months ago, these products have collectively attracted about $14 bln, with BlackRock’s iShares Bitcoin Trust (IBIT) leading this race.

While SEC reluctantly gave the green light to the first US spot-Bitcoin ETFs, BlackRock CEO Larry Fink also changed his stance. From calling Bitcoin an “index for money laundering“ in 2017 to seeing it “change the entire ecosystem“ this year, he has come a long way. And with that, IBIT became the “fastest-growing ETF in the history of ETFs.”

Moreover, IBIT has finally surpassed Grayscale Bitcoin Trust (GBTC) as the world’s largest Bitcoin ETF as the total BTC held by BlackRock’s product reaches 288,670 BTC compared to Grayscale’s 287,450 BTC.

While IBIT began trading in January and started with zero, Grayscale began the year at 620,000 BTC. So, ever since GBTC’s conversion, it has lost more than half of its holdings as investors finally got the chance to get out. Having said that, Grayscale did see some inflows in May, according to Farside. This has been due to Grayscale’s plans to launch a mini ETF with a reduced fee of 0.15%.

According to regulatory filings, BlackRock’s income and bond-focused funds—the Strategic Income Opportunities Fund (BSIIX) and the Strategic Global Bond Fund (MAWIX)—purchased shares of its spot ETF in the first quarter.

Buying activity for BlackRock’s fund recently ramped up amidst the bullish sentiment for the broader crypto market, marking a shift in IBIT, which has seen either zero or no inflows in the first half of the month.

Overall, spot Bitcoin ETFs are now holding one million BTC worth about $69 bln, amounting to about 5.10% of BTC’s circulating supply. US-listed Spot Bitcoin ETFs, meanwhile, are now holding 2.67% of Bitcoin’s total supply, as per data provider Arkham.

It has been the approval of these spot Bitcoin ETFs that helped BTC’s price recover from the 2022 bear market and hit a new ATH at $73,740. Now, the market is expecting Ether to pull a similar move.

Spot Ether ETF Approval

Up until the beginning of last week, the crypto market was expecting the SEC to reject the Spot Ethereum ETF when suddenly the sentiments shifted, and the agency asked the issuers to make changes to their applications.

This sudden and rushed move by the SEC saw the ETH price surging. ETH started in May at around $3K and traded under $3.2K when, on May 23rd, it surpassed $3.9K. As of writing, ETH/USD has been trading at $3,750, with Ether’s gains in May coming in at 24.2% after recording a loss of 17.3% in April.

Unlike Bitcoin, Ether’s Q2 returns are currently at a positive 2.23%. Still, as per CoinGecko, Eth has yet to hit a new high and is still 23.3% away from its 2021 peak of $4,878.

However, things might change for ETH soon, as it is going to get its very own ETF. Crypto analysts actually expect Ether’s price to see much more impact than Bitcoin’s, even if it sees anywhere between 5% and 20% of BTC’s flows. This is because Ether has a lower market cap of $450.2 bln compared to Bitcoin’s $1.3 trillion. Moreover, 27.20% of ETH’s supply is currently locked via staking.

Eth futures OI surged from $10.13 bln at the start of May to almost $16 bln now. But while CME leads Bitcoin futures, Binance is still at the top with $6 bln in OI, followed by Bybit ($3.15bln) and OKX ($2.21bln). CME is at the fifth spot, having $1.19bln.

This is all even before the ETF has started trading. So far, the SEC has only approved the 9b-4 filings. Ether ETFs are currently facing their last hurdle before their launch, which is the S-1 approval.

The potential spot for Ether ETF launch may still be as early as the end of June, according to Bloomberg’s senior ETF analyst Eric Balchunas, who calls this a “legitimate possibility.“

This projection comes after BlackRock filed an updated version of the S-1 application for its Spot Ethereum ETF. According to the amended application, the ETF will trade under the ticker ETHA and will not be staking ETH. Moreover, the S-1 noted that a BlackRock affiliate firm has “agreed to purchase $10,000,000 in Shares“ and has taken delivery of 400,000 Shares at a price of $25 per share.

BlackRock’s CEO, who has changed his negative Bitcoin stance, is actually far more bullish on Ethereum. As he said last year:

“The tokenization of securities will define the next generation of markets.”

In addition to BlackRock, Fidelity, Franklin Templeton, VanEck, ARK Invest, Invesco Galaxy, Bitwise, and Grayscale have also filed for Spot Ethereum ETFs. Hashdex meanwhile pulled its application just a day after getting the approval as it “no longer intends to move forward with a single asset Ether ETF.”

Now, the impact of institutional and retail flow from the launch of these ETFs is expected to vary. Some speculate that ETH will rally hard, as investing in an ETF would be betting on DeFi, NFT, and Web3 growth. Bernstein has called for the combined Bitcoin and Ether ETF markets to be worth $450 bln.

Meanwhile, others are predicting pressure from Grayscale Ethereum Trust (ETHE). According to Kaiko research, “it is reasonable to expect selling pressure on ETH from likely outflows or redemptions due to Grayscale’s ETHE,“ which is the largest ETH investment vehicle currently having over $11 billion in AUM. If ETHE sees a similar magnitude of outflows as GBTC did, Kaiko projects $110 million of average daily outflows.

Even if inflows are disappointing in the short term, it is noted that Ethereum ETF approval is positive for the broader market. The move will have market-wide implications as it signals that ETH without staking is a commodity and not security. This can remove the regulatory uncertainty that weighed on ETH’s performance over the past year.

While the Ethereum ETF has yet to be launched, the market is already speculating which coin will receive the next ETF, with many speculating that Doge and Solana will be next in line to receive institutional attention.

SEC Reaches an Agreement with Terraform Labs and Do Kwon

May also saw stakeholders efficiently reaching a legal settlement in one of the most discussed cases in the crypto asset space. Terraform Labs and Do Kwon reportedly reached a settlement with the Securities and Exchange Commission.

According to the latest information available from the District Court for the Southern District of New York, a May 29th telephonic conversation that did not have any transcription or recording got the scheduled oral arguments canceled on behalf of the counsels of all the parties as they ‘reached a settlement in principle.’

Further proceedings in this case would involve parties filing documents in support of the settlement in front of the court, which would be presided over by Judge Jed S. Rakoff by June 12th.

In the first week of April, a Manhattan jury found Terraform Labs and its co-founder Do Kwon liable for civil fraud charges. The Securities and Exchange Commission had pressed these charges, alleging that Terraform Labs and Do Kwon had misled investors on their ‘algorithmic‘ native stablecoin Terra USD (UST), leading to a US$40 billion implosion of the Terra ecosystem in May 2022.

In the latter half of April, the SEC had requested the judiciary to direct Terraform Labs and Kwon to pay $4.74 billion in disgorgement and prejudgment interest, as well as a collective $520 million in civil penalties: $420 million from Terraform Labs and $100 million from Kwon’s pocket. However, the proceedings then went up for a settlement as Terraform informed that they had only approximately $150 million in assets remaining without ‘no illegal profits…to disgorge.”

Reports suggest that Do Kwon is currently on bail in Montenegro, awaiting extradition to either the US or South Korea, two jurisdictions where he faces criminal charges.

US SEC Commissioner Suggests UK-US Collaboration on Digital Securities Sandbox

In April 2024, the Bank of England and the Financial Conduct Authority commenced a consultation that aimed to deal with the country’s five-year Digital Securities Sandbox (DSS). The aim was to facilitate innovation in promoting a safe, sustainable, and efficient financial system, protecting financial stability, market integrity, and cleanliness.

In doing so, the role of the DSS was imagined as a framework or paradigm that would allow firms to use cutting-edge, modern-day technologies, such as Distributed Ledger Technology, to facilitate the issuance, trading, and settlement of security instruments like shares and bonds.

Many were taken aback when Hester Peirce, the SEC Commissioner, responded to this consultation a day ago, at the very end of May 2024. Reports suggest that in her response, Hester advocated for the UK and US to conduct an international sandbox together. She also acknowledged that her view was necessarily not that of the US SEC and was not meant to become a reality with immediate effect.

Peirce was quoted saying that a joint-effort sandbox:

“Would benefit regulators by producing more data on how complex emerging technologies operate in different contexts than would be possible with a single jurisdiction sandbox.”

Adding further specificity to her suggestion, Peirce said that the SEC could build a two-year micro-innovation sandbox that would allow entrants to select which rules they want to temporarily waive. However, such suggestions or selections would have been supplemented with plans and strategies on how to mitigate risks that could arise from the absence of the rules.

Although things are still in a speculative domain where suggestions and recommendations are being exchanged, many believe that Commissioner Peirce’s advocacy for an internationally collaborative sandbox is aligned with the distinctive characteristics that shape tokenization as something that encourages more global trading and investment.

While Peirce advocated for US-UK collaborations and greater system opening, the New York Stock Exchange divulged its plans to introduce cash-settled spot Bitcoin Options.

NYSE to go for Bitcoin Options

The NYSE said these options will be available simultaneously with CoinDesk Bitcoin Price Index (XBX) price tracking. However, the implementation is subject to regulatory approval. Jon Herrick, the Chief Product Officer of the New York Stock Exchange, was quoted saying:

“As traditional institutions and everyday investors are demonstrating their wide-ranging enthusiasm for the recent approval of spot bitcoin ETFs, the New York Stock Exchange is excited to announce its collaboration with CoinDesk Indices.”

If approved by the regulator, these instruments would provide investors with access to an ‘important, liquid, and transparent risk-management tool.’

The New York Stock Exchange operates under the ambit of ICE, InterContinental Exchange. ICE is already offering such instruments in the form of ICE Futures Singapore.

Even in the United States, ICE’s venture into the Bitcoin derivatives space dates back to 2018, when ICE started a crypto subsidiary, Bakkt, and launched physical delivery of Bitcoin futures traded on ICE Futures US.

However, these instruments failed to gain enough popularity, leading Bakkt to make a pivot.

What’s Ahead?

Besides the big positive news of Ether ETF, PayPal has launched its stablecoin on the Solana blockchain, while Mastercard introduced a new group of startups to drive innovation in blockchain technology.

This past week, celebrities also made a return to crypto, with the likes of Caitlyn Jenner, Iggy Azalea, and Davido launching their tokens. However, celebrities embracing crypto haven’t really been net-positive for crypto and have been hit with SEC charges in the past.

The month also saw Bitcoin’s increasing adoption as a treasury reserve asset. While not a big name, the medical tech company Semlar Scientific announcing Bitcoin as its primary treasury reserve asset speaks well for the crypto king. This strategy, Semler chairman Eric Semler said:

“Underscores our belief that bitcoin is a reliable store of value and a compelling investment.”

The company purchased 581 BTC for about $40 million.

Another company, Metaplanet, announced that its board of directors has passed a resolution to add 250 million yen (about $1.6 million) worth of BTC to its 1 billion yen BTC stash.

Microstrategy, which holds 214,400 BTC, Block, and Tesla are other companies that keep BTC on their balance sheets.

Not just corporations but even governments are interested in BTC. This month, the senior leadership of the Argentinian National Securities Commission (CNV) met with the National Digital Assets Commission (CNAD) of El Salvador regarding Bitcoin adoption. El Salvador is the first country to adopt Bitcoin as a legal tender and holds 5,748 BTC.

In the Bitcoin mining sector, Riot—a company with $1.3 billion of BTC and cash and no debt on its balance sheet—is trying to acquire Bitfarms, a rival miner in which it already has a 9.25% stake. As BTC mining becomes “tougher for smaller players,“ Bernstein analysts expect the US-based industry to consolidate into five large players from over 20 publicly listed miners currently.

A couple of weeks ago, Kaiko also noted in its research that Bitcoin miners started to feel the pressure of Bitcoin halving in April, which slashed miner rewards. While daily average network fees spiked after the big event, which offset some pain for miners, it has come down since and “could lead to selling pressure from miners.“ And if miners are “forced to sell even a fraction of their holdings“ to cover their operating expenses in the coming months, “this would have a negative impact on markets,“ noted Kaiko.

So, in the near term, things are not looking too good for crypto, though renewed interest and action are expected towards the end of the year.

Click here to learn all about investing in Bitcoin.