Republic First Bank’s Fall: Crypto’s Turning Point

The 2024 failure of the United States Bank was the closing of the Republic First Bank in Philadelphia by the regulators.

The announcement caused all the major cryptocurrencies—Bitcoin, Ethereum, and several altcoins—to take a little dip, which started quite a bit of debate among the crypto community.

The latest financial institution to fall is Republic First Bank. “Yeah, I think I’ll stick to Bitcoin,” said Zesh CEO Marius Martocsan in an X post on April 26.

The point of view was offered by Pillage Capital, an anonymous trader, in a post on X on April 26 that we should look at the downfall of Republic First Bank, as bank failures provide the best narrative for cryptocurrency.

On April 26, 87,100 X followers of crypto commentator Randi Hipper were asked this question: “How many more failures are needed before individuals start to book as their bank?”

On April 26, the Pennsylvania Department of Banking and Securities seized Republic First, and the FDIC was appointed as receiver. As stated in a press release issued by the FDIC on April 26th, the agency will take over almost all deposits and purchase all the assets of Republic Bank.

As of January 31st, Republic First’s total assets were roughly $6 billion, with total deposits of $4 billion.

In addition, by no later than the beginning of next week, all thirty-two locations of the bank in the states of New Jersey, Pennsylvania, and New York will be back in business as Fulton Bank.

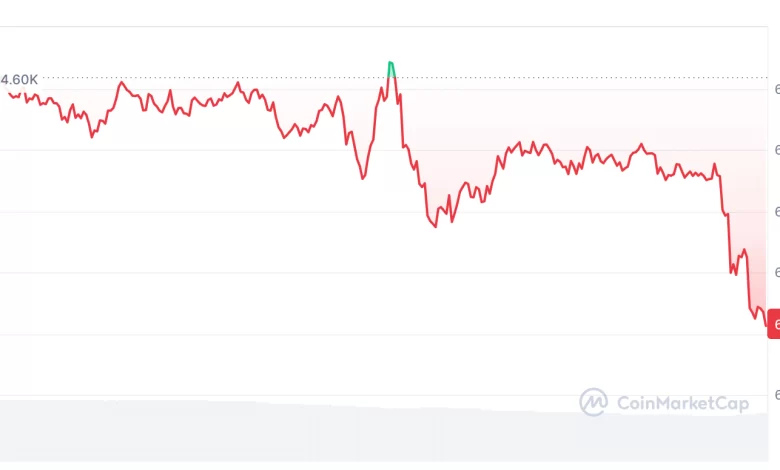

Even in 2023, when reports of potential bank failures surfaced, the price of Bitcoin spiked for a brief while; however, it has since fallen significantly.

Bitcoin has lost 1.16% and is now trading at $62,715, according to statistics from CoinMarketCap, while Ether has lost 0.58% and is now trading at $3,095.

Dogecoin dropped by 2.88% and Solana by 1.79% during the same time, which means that cryptocurrencies had a rather more pronounced fall.

This statement follows a tough year for the banking industry, with five bank failures in the United States reported in 2023, as per FDIC data.

In May 2023, when the initial recovery efforts had failed, JPMorgan acquired First Republic Bank, a separate entity that has no relationship with Republic First.

Seeking to protect the American economy against “systemic risk,” the Federal Reserve said in March 2023 that Signature Bank would be closed.

It came right after the order to close Silicon Valley Bank. Only seven days earlier, Silvergate Bank, another crypto-friendly financial institution, announced that it would voluntarily liquidate and terminate all operations.

You can freely share your thoughts and comments about the topic in the comment section. Additionally, please don’t forget to follow us on our Telegram, YouTube and Twitter channels for the latest news and updates instantly.