Top 10 Common Mistakes New Crypto Users Make

It’s worth your time to learn the top 10 common mistakes new crypto users make to ensure you avoid needless losses. Entering the decentralized market is easier than ever, and more people are seeking blockchain solutions. Whenever you have a combination of new tech and users, there will always be some errors.

İçindekiler

A small error may result in a missed opportunity or delay in your strategy, whereas larger errors can lead to catastrophic losses. Nobody wants to lose their hard-earned crypto. As such, it’s your responsibility to learn the common mistakes new crypto users make and why and how to avoid them.

1. Having Unrealistic Expectations

Many people enter the crypto market during market upswings in hopes of catching a big break. The internet and news are filled with stories of these individuals and how they spend their newfound wealth. While their stories are inspiring and motivating, they are a bit misleading.

Entering the crypto market isn’t like getting signed on a professional basketball team. Even if you have skills, you are not guaranteed massive returns. The market is volatile, and your returns will fluctuate depending on the project and your strategy.

In the crypto community, this mentality is called “Chasing Lambos.” This reference emerged following the 2017 crypto bull run. At that time, the combination of social media, fast-paced gains, and exciting new technology combined to create a unique gold rush feeling for traders. Fast forward a year, and you will see that many of these individuals are no longer boosting their earnings.

Yes, there are incredible opportunities in the crypto market. However, as a new trader, your strategy should focus mostly on established projects. Projects like Bitcoin and Ethereum continue to provide ROI opportunities that add up over time.

2. Not Understanding the Technology

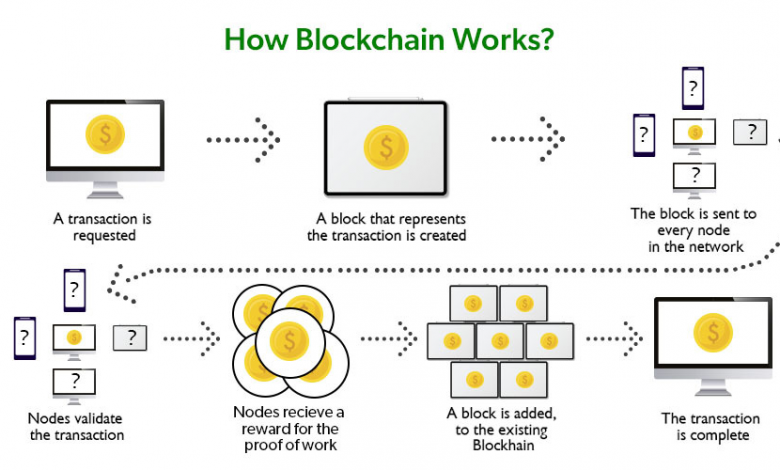

Blockchain technology is not a mythical creature, and it is not even hard to understand. It’s a decentralized network of nodes that share network responsibilities to improve security, transparency, and performance. It is never a good sign when a person starts trading cryptocurrencies but has no understanding of the underlying technology.

This understanding will serve as a crucial point of reference in determining the viability of future projects. For example, everyone knows what a car is capable of, more or less. As such, if someone told you they had a car that could run without fuel, you would be skeptical. At the very least, you would want to do more research on their processes

Source – Geeks for Geeks

Understanding the technology also helps you to gauge a project’s true utility, functionality, capabilities, and drawbacks. An educated crypto trader can look at a blockchain consensus mechanism and determine if it is eco-friendly or power-hungry. They can also determine if promised and not yet delivered features are pushing the boundaries of the tech or completely possible.

Blockchain technology continues to evolve. Today some blockchains integrate other powerful technologies like the IoT (Internet of Things), AI (Artificial Intelligence), and NFC (Near Field Communication) systems. These integrations present great opportunities for those who understand enough to determine what projects possess long-term qualities

3. Not Taking the Time to Learn the History of the Market

The crypto market has an interesting history. Even before Bitcoin entered the market, there were many attempts to create digital currencies. It can be an eye-opening experience when you learn that Bitcoin was the culmination of many technologies combined with a timestamped hash to create a reliable digital currency that couldn’t be double-spent.

Learning the history of the crypto market also brings the added benefit of becoming familiar with the industry’s top developers and founders. With their innovative and game-changing platforms, these individuals have driven the blockchain space to new heights. Individuals like Vitalik Buterin, Ethereum’s cofounder, revolutionized the market.

The history of the crypto market will help you to better understand the technology as well. You can see how cryptocurrencies evolved from digital cash and SoV (store-of-value) assets, into a massive economy of utility, currency, and DeFi options. It will be much harder for someone to promise you the world when you know the history and technical basics of blockchain tech.

Understanding the market’s history also includes learning about major market trends in the past. For example, if you take the time to study Bitcoin’s bull and bear runs, you will gain more confidence during market cycles. These factors demonstrate how important crypto history can be to your approach.

4. Not Recognizing the Market Leaders

As a new trader, it’s easy to log into a crypto exchange and start trading three-letter cryptos based on your feelings or if the stick is green or red. This is the way most people enter the market and it’s also the reason that many people leave the market dissatisfied. What those users didn’t understand is that every trader needs some established projects in their portfolio.

There are market leaders in all industries, and the crypto market is no different. Recognizing who is a market leader and how they got to their position is a great way to lower your workload. For example, if you know that a project is backed by Google or another major firm with high-quality standards, it can help you expedite your analysis process.

Every sector in the crypto market has leaders. Bitcoin is the most popular, original, and most recognized cryptocurrency. There are also leaders in the smart contract programmable, DeFi, logistics, file sharing, gaming, and security sectors.

Always find out who the market leader is, what they offer, and their competition. These factors serve a crucial role in buffering any less established and often riskier projects you decide to add to your portfolio in the future.

5. Getting Tunnel Vision

Tunnel vision occurs for traders when they get fixated on a single project. This situation usually occurs due to high involvement in the project’s community. Projects that have large active communities are the best option for traders. However, you don’t want to get caught up in the cult-like obsession with a single project.

When you focus all your attention on a single project, it isn’t ideal because you may miss other opportunities. Plenty of traders only trade Bitcoin and their strategy has worked for them to date. However, problems arise when you have this level of tunnel vision but on a project that lacks substance.

You can see this scenario play out in reality across social media. Some users vigorously defend projects as if they are the end-all-be-all of the tech. Blockchains continually evolve, and most of these networks will grow and innovate until they slowly fade away to more advanced options.

6. Going to Experimental

The crypto market has come a long way since the launch of Bitcoin 15 years ago. Over this time, new concepts, consensus, and token types have emerged. Each of these new crypto upgrades helps to drive innovation and adoption. However, just because a project is new or has new features doesn’t mean it’s a good addition.

Every new project or platform has to go through some growing pains before it’s a viable and reliable option. Even crypto exchanges, which still get hacked today, have undergone many iterations in the past. Notably, each failure or hack helped to improve the remaining platform models.

There’s nothing wrong with investing in new concepts and protocols. However, They shouldn’t be the bread and butter of your portfolio. The majority of your holdings should be in tried-and-true options, with only a small percentage allocated to experimental crypto projects.

7. Slacking on Security is a Common Mistake

Security should be a paramount concern for all traders, both new and experienced. As such, you need to spend some time learning about crypto security protocols, processes, and devices. Raising your level of understanding in these areas will ensure that you integrate a dependable and effective security model.

A perfect example of a new trader lacking in security is when they leave their tokens on a CEX. Centralized exchanges like Binance are the first place most people get into the market. These large platforms provide a proven way to access crypto features. However, they aren’t always secure.

Hardware wallets are devices created specifically to store crypto offline in cold storage. Cold storage prevents online threats and is the industry standard in terms of crypto protections. Most hardware wallets achieve this goal by using a simple air gap and button. Even the world’s greatest hacker can’t press a physical button without being next to the device.

8. Being Too Public in Your Actions

Social media is a great tool for promoting new projects and sharing your experiences with others. Over the last 5 years, the influence of these platforms has increased significantly across all parts of life. Today, social media influences everything from how people dress to what they buy, invest in, and even eat.

Being part of the crypto community on a social media platform is a great way to share your interests and interact with others meaningfully. However, there are some risks you need to be aware of when sharing your crypto experience on social media networks. For one, discretion is your best defense against theft.

Never say how much crypto you hold, where you store it, and other vital details that can result in you going from an inspiration to a target. In the past, social media posts have resulted in people posting information that could be used to access their accounts, locate their crypto, or cause other damage to the individual posting the content.

9. Thinking You’re an Expert

One of the biggest problems that many new traders face is simply the ability to stay humble. There are times in the crypto market when it can seem like every move you make is a big win. During altcoin season and Bitcoin bull runs, it’s common for new traders to see steady gains.

Notably, just because you have successfully made an investment decision doesn’t mean that you are now an expert in the matter. In many instances, it’s simply that you are in a bull run which raises the chances that your project’s market cap will rise. However, there are lots of traders who then take this little victory and try to convert it into a career.

There was a flood of crypto influencers on YouTube and Twitter in 2017. These individuals would often give horrible advice to other new traders that they highlighted with their past successes. The problem with this advice was that it was not applicable during a bear market. As such, many of these crypto influencers are no longer active or in the market.

10. Not Triple Checking Everything

There are lots of ways that human error can result in you losing your crypto. For example, there are no refunds on Bitcoin’s blockchain. This fact means that they’re gone forever if you send your coins to the wrong address. Sadly, there are roughly around 3M Bitcoins reported to have met this fate.

The same goes for researching new projects. The rise of DEXs (Decentralized Exchanges) added to user flexibility and security. It also enabled any project to seed a liquidity pool and gain access to public funding. This open nature helped to drive adoption, but it also had an unintended effect: more scams.

Soon, projects began to pop up on popular DEXs with the same name as other established platforms. These projects confuse new users and can lead to them participating in a platform they didn’t seek to join. The best way to avoid this scenario is to always verify the contact address of DeFi projects before trading them.

Every crypto project has a smart contract address. You can use a blockchain explorer to certify that the project you want to send funds to is the same one you are currently looking at. There are even special AI tools that can streamline this process for traders and help you avoid common mistakes.

Avoid Common Mistakes New Traders Make

Now that you have a better understanding of common mistakes new traders make, you are better prepared to build up your portfolio and security. Always DYOR, and don’t get caught up in the hype of a project before you can verify its crucial details. If you follow these steps, you will avoid the most common mistakes new crypto users make and prosper.

You can learn more about exciting blockchain projects here.