Top Altcoins To Watch Next Week: Investors Switch Focus Toward Bonk (BONK), Injective (INJ) And Celestia (TIA)

The market has experienced significant selling pressure in the past week, particularly after Bitcoin’s momentum weakened around the $44,000 mark. While Bitcoin continues to recover its previous momentum, several new altcoins have come into the spotlight, recording massive gains. This has somewhat surpassed leading altcoins such as Solana and Cardano as Bonk, Injective, and Celestia have been touching new highs each day.

İçindekiler

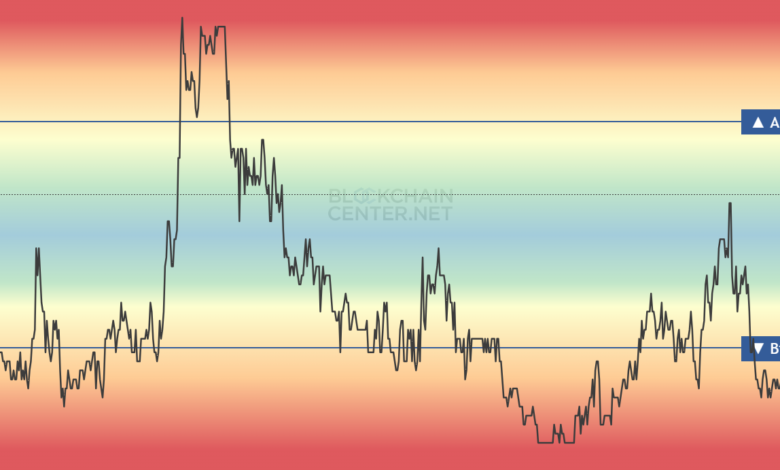

Altcoin Season Index Touches High After 14 Months

The Altcoin Season Index, an important barometer in the market, has recently achieved a notable high after 14 months. This index serves as a tool for investors and analysts to evaluate the performance of various altcoins in comparison to Bitcoin.

Presently, the index trades at 59, with its notable rise occurring on December 7th. This increase was triggered due to the downturn in Bitcoin’s value, which forced investors to redirect their investments towards altcoins. However, in this case, the surge in capital investment favored newer altcoins displaying significant gains, rather than the more established ones. Additionally, a decline in inflation has strengthened buying activity in the market.

Bonk (BONK) Price Analysis

The Bonk price has faced resistance at the $0.000035 mark, as sellers defended further price increases, pushing it towards the 23.6% Fib level. Despite this, there is a noticeable intent among investors to buy more during this price dip as they defend the EMA20 level.

Should the price rebound notably from its 20-day EMA, it would suggest that investors are actively buying during these lower price trends. If this trend continues, the buyers might once again try to break through the $0.000035 threshold. A successful effort in this regard could potentially create a new high for BONK price next week.

Injective (INJ) Price Analysis

Injective price has broken its all-time high recently, settling above $30. However, the price is struggling to hold near EMA20 as bears recently rejected $35. As of writing, INJ price trades at $30.7, declining over 6.8% from yesterday’s rate.

If buyers maintain the upward momentum above EMA20, the INJ price could potentially surge to a high of $41-$42. The rising trend in moving averages suggests a favorable position for buyers despite increasing short-positions near resistance level.

Celestia (TIA) Price Analysis

Celestia recently rebounded from its 20-day Exponential Moving Average (EMA) priced at $13.2. However, the bulls are struggling to push the price above the $15 mark.

As of now, the bears are attempting to drive the price below the 20-day EMA. Should they succeed, there’s a possibility of a correction to balance demand and supply, potentially causing the price to consolidate above $10.

Currently, both moving averages are trending upwards, and the Relative Strength Index (RSI) is in positive territory, suggesting that buyers have the upper hand. A break above the channel’s pattern will send the price toward a new high next week.